Option Strategies on Bitcoin through IBIT

February 20, 2025

The Markets at a Glance

New highs are now in for SPY and QQQ, though IWM remains more than 7% below its December peak. VIX, as would be expected with new highs, is subdued in the 15-16 range and dipped below 15 in recent days. So, while there are news announcements flying all around about tariffs, the war in Ukraine, new cabinet members, government job cuts, and other executive actions, the investment audience appears to be feeling pretty good about where it's all going right now for stocks.

The former tech leaders have been mixed, however, with GOOG and MSFT having sold off, while NVDA remains strong. META set a new high recently at 740.91, though sold off by 37 points over the last two days. Generally speaking, the fact that leadership is spreading out beyond the Mag 7, however, is a positive.

It's a unique time for the market, with so many things up in the air politically and so many people seriously concerned about some of the new administration's actions and appointments. Meanwhile, however, there seems to be a common sense among market participants that the environment will continue to be pro-business regardless of what happens. And while there are undercurrents of concerns, we are not seeing either VIX or the put-call ratio indicating that exceptionally large numbers of puts are being purchased right now.

With all the attention on the White House lately, one item that has been taking a breather is bitcoin. As I discussed back in the Fall, the best way to play bitcoin using option strategies is through the iShares Bitcoin Trust ETF (IBIT). So, today's strategy talk will look at that.

Strategy Talk: Bitcoin Strategies Using IBIT Options

Bitcoin had a strong surge in price last Fall in anticipation of the Trump administration being very supportive to crypto trading. But after reaching above 108,000 in price last December and 109,000 in January, bitcoin has dropped back to the mid-90,000s. For those who want a pure play on bitcoin but want the ability to implement option income or hedging strategies, IBIT provides that ability. (FRBT and ARKB also hold bitcoin and have options, but the options are much less liquid.)

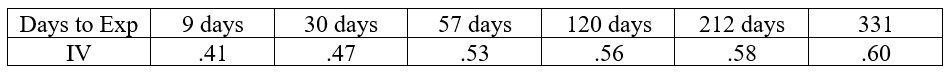

Given the volatility of bitcoin, IBIT's options trade at implied volatilities of between 40-50% for near-term expirations, yielding attractive premiums for covered calls or put writes. Interestingly, the IVs have a slight rise (to 50-60%) as the durations lengthen. Here is a table of IVs for the 55 call (with IBIT at 54.65) in the various expirations currently available.

The upward skew is a bit unusual. When you look at the price quotes versus Black Scholes values, the near-term options track reasonably well with their theoretical values. That says the options are fairly priced, given IBIT's actual volatility of the last few months. But as you view more distant expirations, the option prices begin to exceed B-S value, suggesting that the market expects bitcoin to increase in volatility over time.

From a strategy perspective, that says not to go out too far in time if you are buying long calls. For call or put writes, the longer-dated options will be a bit richer, but you need to weigh that against other factors, such as liquidity and theta considerations.

The liquidity and price of IBIT options can also support hedging strategies using puts, put spreads, or collars. In my view, owning IBIT rather than bitcoin itself is far easier and more strategically flexible. Bitcoin may still have substantial upside potential, but it's had some huge declines as well. That's precisely the type of instrument for which an option strategy can be advantageous over simply holding it long.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.