Calculating Borrower Defaults Using Agency Data

February 18, 2025

Agency loan-level data from Fannie Mae, Freddie Mac, and Ginnie Mae contains a wealth of information but excludes borrower defaults (with the exception of the more limited Single-Family Loan Performance dataset). What is the best way to use this data to calculate borrower defaults that can be applied to Non-Agency 2.0 collateral or to compare the credit performance of different types of agency collateral? We demonstrate one approach below.

Although agency data provides loan-level delinquency information, delinquent loans are typically bought out either by the GSEs or by Ginnie Mae servicers. Therefore, collateral delinquencies in any given month do not necessarily provide an accurate measure of its credit performance.

One approach is to calculate cumulative buyouts and then add the latest month's percentage of seriously delinquent loans. This measure becomes comparable to cumulative defaults, as used in Non-Agency collateral analysis.

The IVolatility Data-Driven Portal automates this type of analysis for any collateral type and time period. We illustrate this with two figures below:

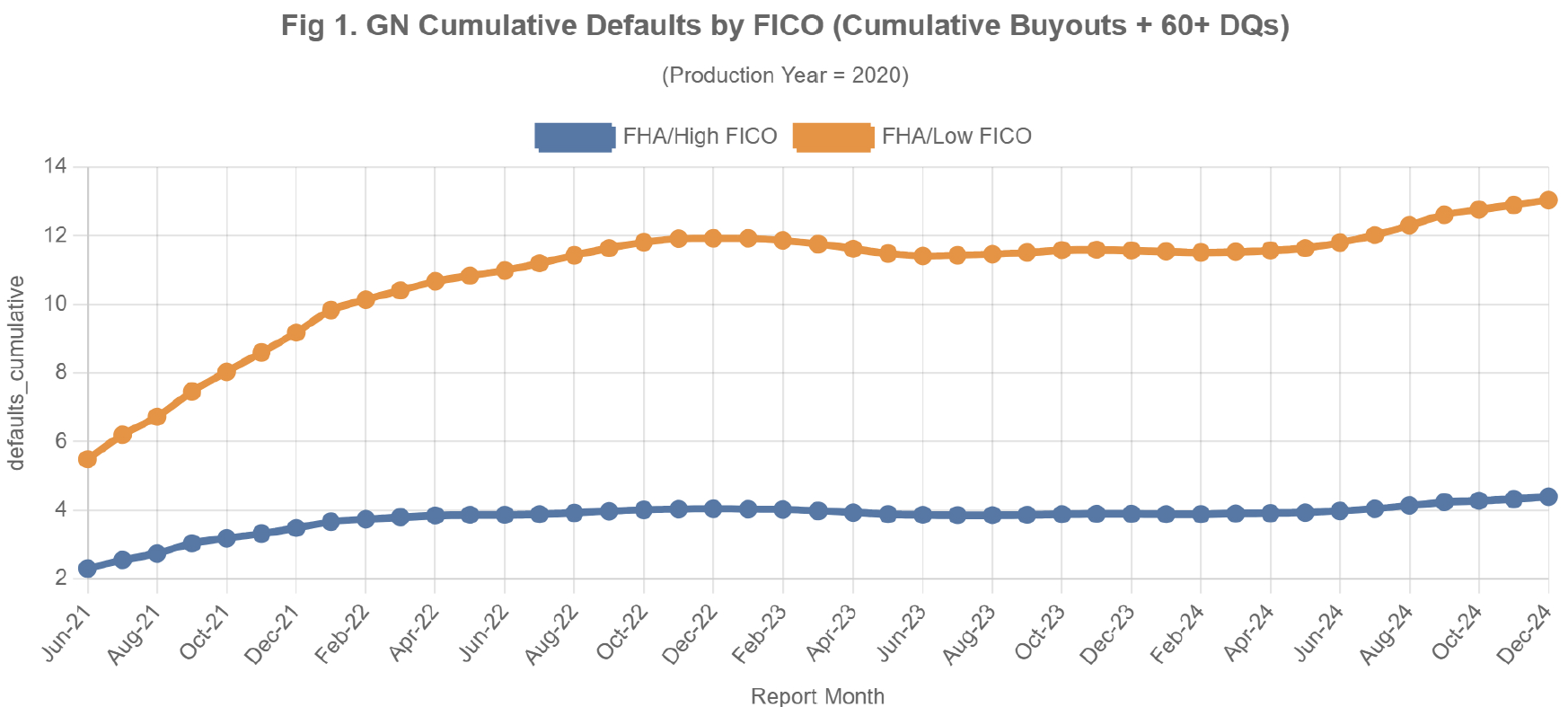

- Figure 1 shows cumulative defaults for Ginnie Mae 2020 production-year Low-FICO and High-FICO collateral from December 2020 to February 2025. As expected, cumulative defaults for Low-FICO collateral are significantly worse (about 13% of the original balance) compared to High-FICO collateral (about 4%).

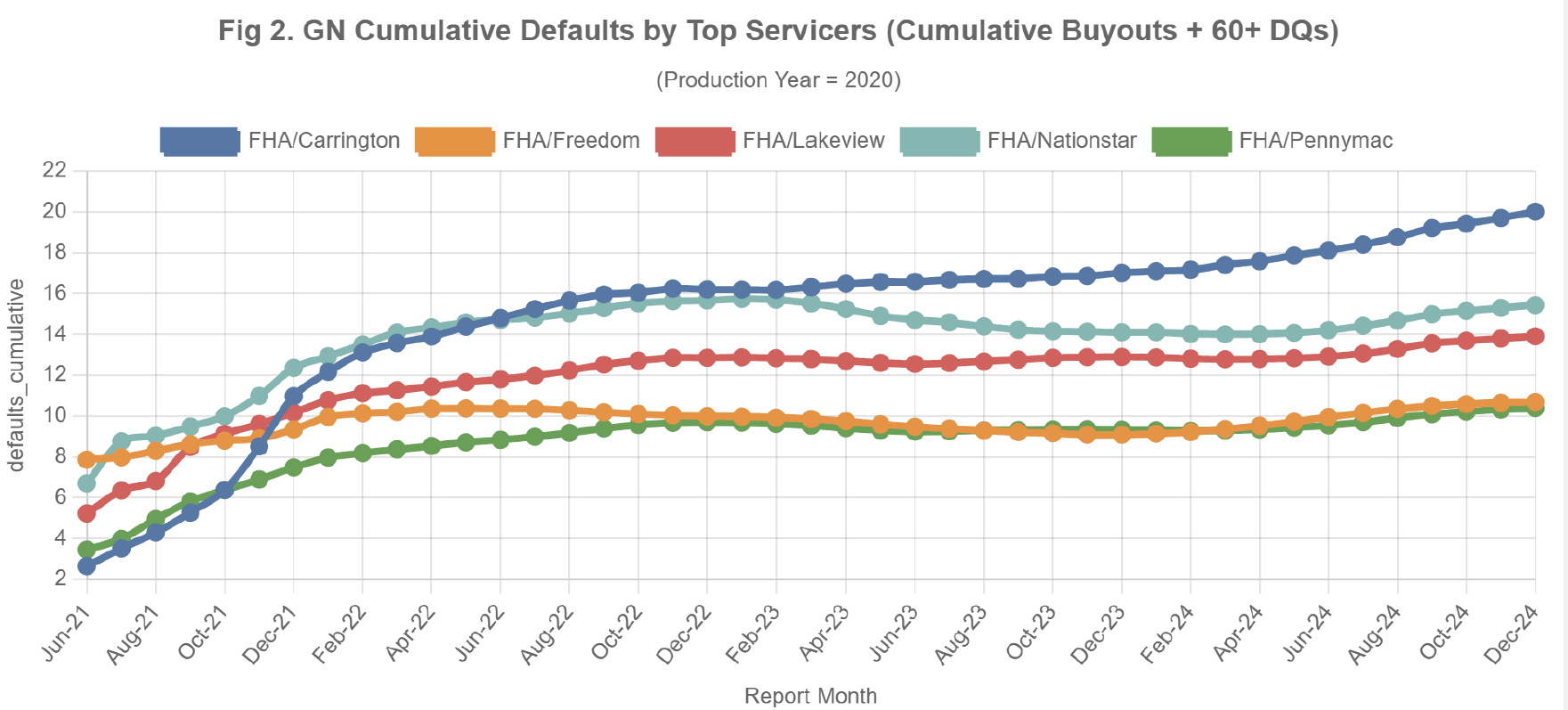

- Figure 2 presents cumulative defaults for the top five Ginnie Mae servicers. Carrington exhibits the worst credit performance, whereas Pennymac has the best.

Free Trial

The data and analytics used in the figures below can be accessed by requesting a free trial HERE.

Why Choose Us?

With over 20 years of experience and a proven track record in data and analytics development, IVolatility has served more than 500 institutional clients and 130,000 retail customers. Now, we're bringing this expertise to MBS data and analytics. Discover the benefits of using IVolatility solutions for MBS HERE.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the MBS data insights discussed in this post. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.