The AI Wake-Up Call

January 30, 2025

The Markets at a Glance

Despite the continuing blizzard of executive orders flowing out of the White House last week, (like Super Bowl tickets flowing out of Ticketmaster), a surprising technology innovation from a Chinese startup called DeepSeek managed to overshadow the news of cabinet appointees, tariff threats, and interest rates in moving the market.

The news was that DeepSeek appears to have produced a comparable AI service to Chat GPT at far lower cost. For many companies and industries that are contemplating large investments in AI, this could essentially be good news, as it would lower the costs of these investments. But for companies that have already committed to AI investments using much more expensive technology (software, chips, etc.) or for US manufacturers producing expensive AI products, the news of a cheaper competitor was disconcerting.

In this case, the bad news was highly focused on the handful of US companies that have been the primary beneficiaries of AI optimism over the last few months. NVidia, of course, has been the focal point of the AI revolution from a hardware perspective, having risen 171% in 2024 and being the recognized leader in the AI revolution for its dominant position in the advanced chips thought to be necessary to power AI.

This is precisely how bubbles burst. Euphoric stock prices reflect the desire by market participants to join the party, and the fewer number of ways to do that only makes the bubble larger. In the absence of bad news, the bubble grows, as more participants want in. It can pop on its own from sheer exhaustion or it can pop when new information creates fear among holders. A far cheaper competitor can easily cause such fear, especially when the target is priced for the most optimistic scenario. In this case, the cheaper competitor is actually NVidia itself, since DeepSeek uses their chips as well. But they use older, cheaper ones, which calls into question the need for other customers to pay up for the latest chips and the need for NVidia to invest heavily in producing them.

In reality, DeepSeek news did not move the broader markets much at all. It's just that big tech now swings the cap-weighted indexes like SPY so much that a hit to any of the big players (NVidia certainly being one of those) can drag the index down by an exaggerated amount. Thus, on Monday Jan 27, the market averages performed as follows:

SPY: -1.41%

QQQ: -2.91%

IWM: -0.96%

RSP: +0.07%

Since then, there has been a bit of a recovery bounce but thus far to lower highs, which suggests at least a minor downtrend could now be occurring.

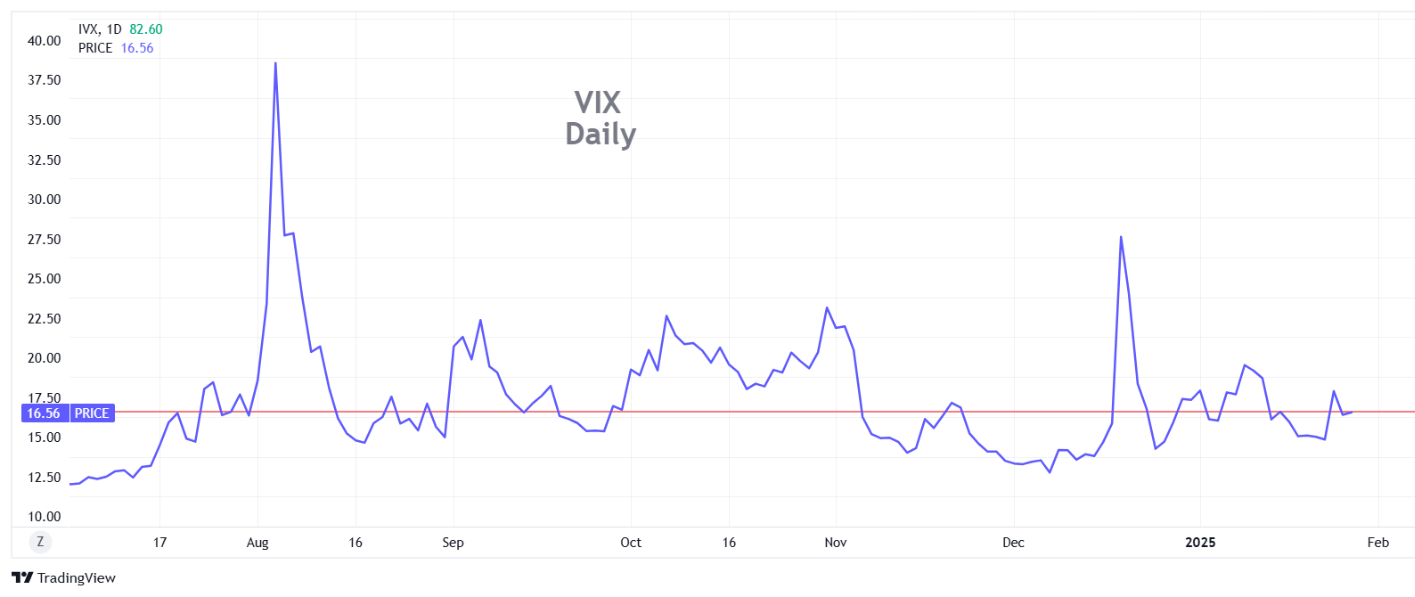

VIX shot to over 19 on Monday, though backed off now to 16. That leaves options a bit rich (at least on the SPY) and that makes for attractive writing. But it also demonstrates how fragile the market is (and techs in particular) at the current levels. Given the uncertainties of the new administration and the questions that have now arisen regarding AI, the rallies of 2024 that were based on both these factors are now potentially unravelling.

Strategy Talk: Hedging With Butterfly Spreads

To continue our previous discussions around hedging, let's take a look today at using butterfly spreads to hedge. At first blush, it may seem more complicated than necessary to hedge a long stock position using a butterfly spread, as the hedge requires three options. However, the butterfly costs (and therefore risks) less than a standard bear put spread and far less than a simple long put.

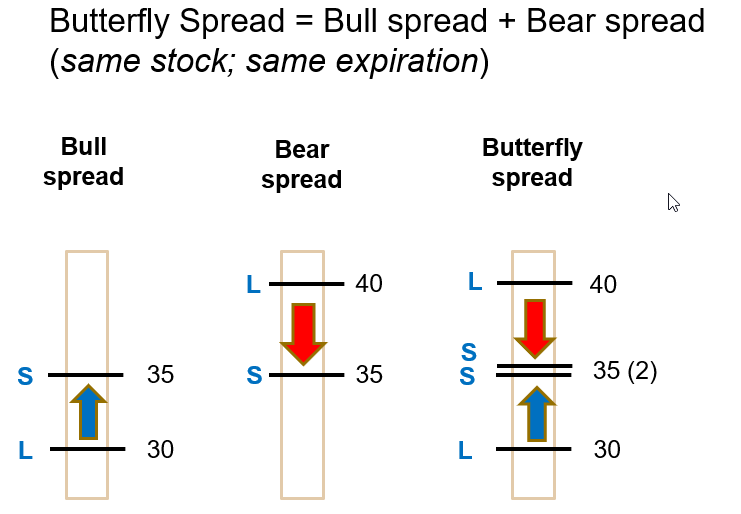

The butterfly spread is a 1-2-1 position: 1 long option; 2 short options; and 1 additional long option, all at different strikes. If hedging a long stock position, the options would all be puts. Essentially, the butterfly consists of two spreads (one bull and one bear) together with a common strike price in the middle.

Generic example: If you had a stock valued at say 42, a basic put butterfly to hedge that position might consist of 1 long 40 put, 2 short 35 puts, and 1 long 30 put. The butterfly makes a profit for stock prices at expiration below 40 (less cost) and maximizes its profit at 35, at which point it begins to lose profit if the stock continues lower. At 30, the profit in the hedge would be gone and the loss would roughly equal the original cost. That, of course, would render the hedge completely ineffective against the loss in the stock.

So, the tradeoff in using a butterfly over a long put or bear put spread is that it costs less and is effective sooner (less cost to recover before hedge takes effect) but it will only provide a direct hedge for a move to the middle strike of the butterfly. Below that, it loses back its profits and eventually loses all its profits if the stock continues downward.

A diagram of this generic hedge is shown below.

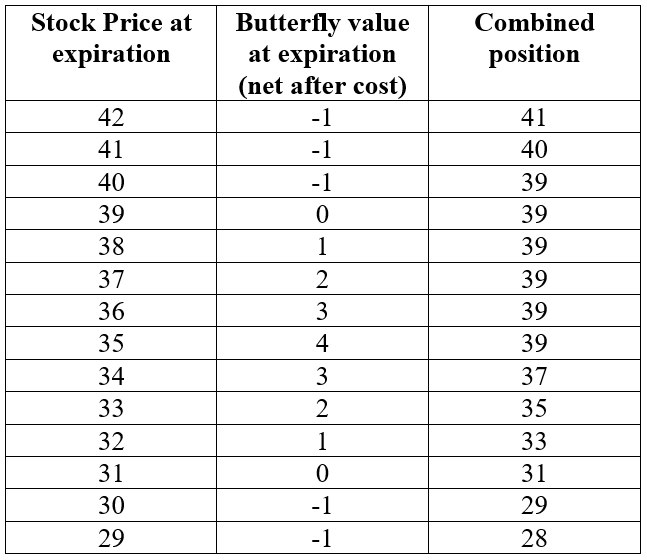

Using the butterfly strategy described above and assuming a net debit of 1.0 for the position, the following table shows what happens to the butterfly-hedged stock position as the stock declines.

The hedge is only effective between 40 and 35 on the downside and at or close to expiration. Thus, the butterfly is effective as the first spread (the bear spread) gains value. If you hedged instead with a bear put spread by itself, it would cost more but would hold its maximum value even if the stock kept falling.

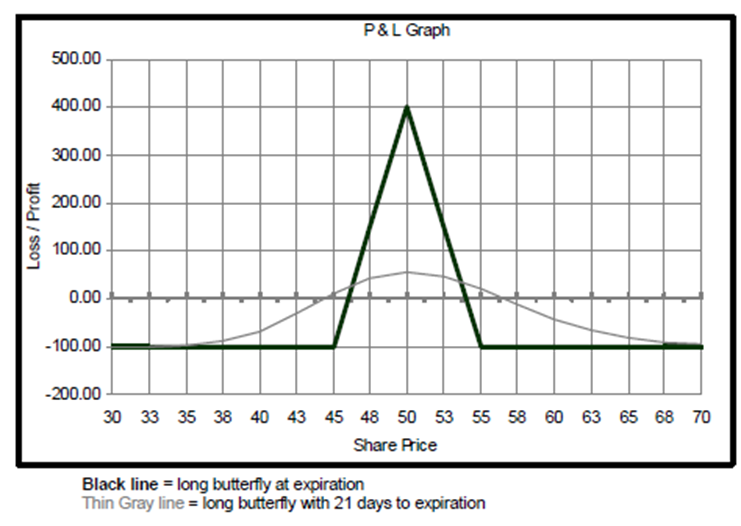

Butterfly hedges should be short term – a few days to a week or two – and cannot be expected to provide an effective hedge until very close (a day or two) until expiration. The profit loss graph is shown below for a 55-50-45 butterfly.

For a real-world example, I executed a butterfly put hedge today in SPY options as follows:

(Feb 14th expiration)

Long 1 595 put

Short 2 585 puts

Long 1 575 put

…for a net debit of 1.14

This gives me a hedge on a long SPY position from roughly 584 down to 575. Since I am also writing calls, I can recover the 1.14 cost fairly easily.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.