Put-Spread Collars

October 10, 2024

The Markets at a Glance

Market participants appear to be happy to continue crawling upward on the proverbial 'wall of worry' as the SPY sets new highs. QQQ and IWM aren't quite into new high territory yet but are close and in uptrends.

The general assumption by the media on the tone of the market is that the latest jobs number allayed fears of a slowdown and that with rates coming down and the economy humming, equities can't help but continue to rise. No doubt, capital is disintermediating from fixed rates back to equity as a result of lower rates, adding a little tail wind to the upward march as well.

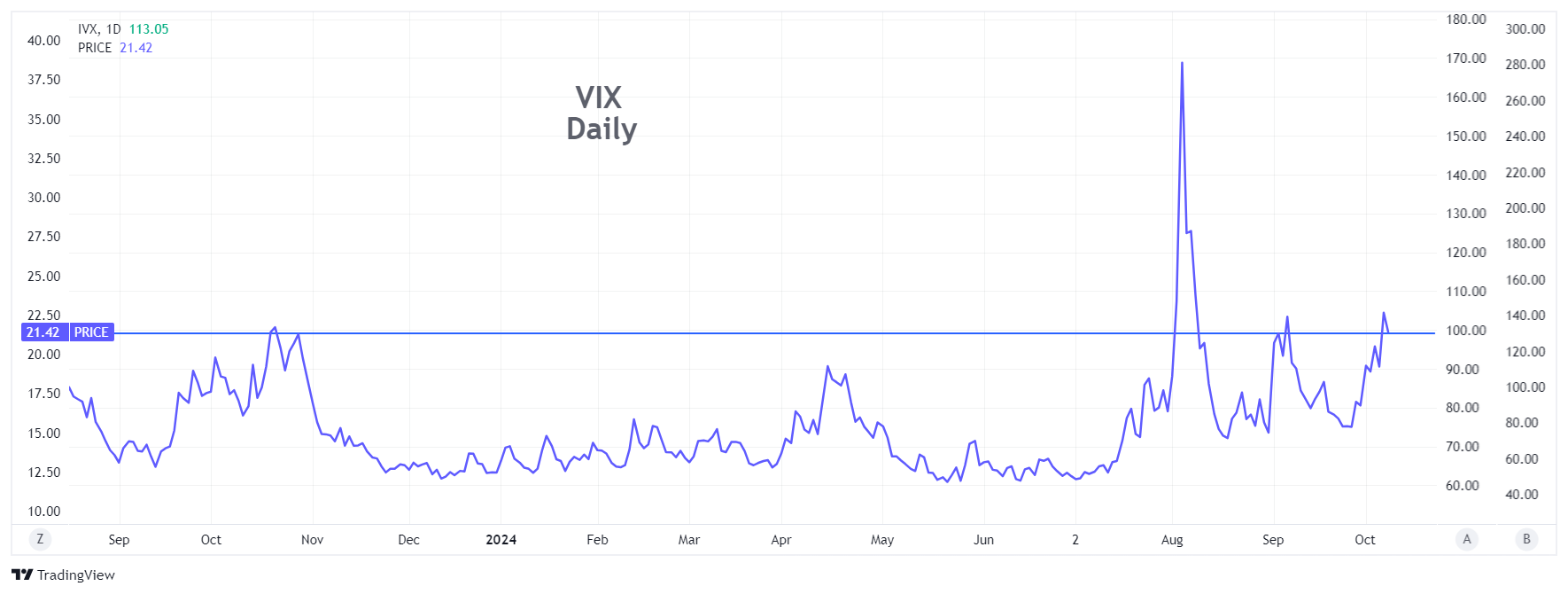

VIX, however, remains above 20 – a rather high level for a market that is trying to look complacent. That says put protection is still in demand by many players, even as prices forge upward.

With implied volatility remaining high and the market grinding upward, covered call and put writing remain attractive. But if you are getting concerned that the market is ripe for a setback on any bad news from the economic front or around the globe, and that a sell-off could be a sharp one, then you might be concerned that even covered writing still leaves you exposed.

While it will reduce the upside potential from call writing, I have an answer for that dilemma.

Strategy Talk: The Put-Spread Collar

I grant you that collars are not one of the more exciting trading strategies. You start with a covered call write, which is conservative to begin with, and then you add a long put, which can pretty much remove most of your remaining potential upside.

But I believe there are occasions when the strategy can be helpful and that a good trader needs to have such strategies for certain situations. I have found that when I have a substantial amount of capital sitting idle (perhaps because the conditions are not to my liking), or when I expect to be occupied with something that will prevent me from keeping a close eye on the markets for at least a few days, I sometimes embrace a collar.

I do, however, make one important adjustment to the basic strategy whenever I use it. Instead of a straight put purchase, I use a put bear spread instead. This offsets some of the cost of the long put and that can make an otherwise unattractive strategy worthy of consideration.

When you add a short put to the strategy, you do reintroduce downside risk, but at a much lower price. This can be managed to whatever level you're comfortable with. Buying a long put by itself is buying downside protection all the way to zero, and in most cases, that is not necessary. As such, selling some of that downside exposure to someone else reduces the cost of that insurance and enhances your returns from the collar.

At present, I acknowledge that the general conditions are still somewhat positive, but I can't help but be concerned about an unforeseen catalyst that could spook investors. So, I do want to participate in the upside but only if I can be well hedged. I have the same feeling about Nvidia (NVDA) after reading articles about how their November earnings could be another blowout to the upside, but the stock's recent history says it is not immune to healthy pullbacks, even amid good news. So, I'll use that as an example. (Note: I am not currently holding a position in NVDA, though I am considering it.) The prices here are from Tuesday's close.

Example: NVDA

Based on Tuesday's closing prices, a possible collar on NVDA for October 18 (9 days hence) would have been priced approximately as follows:

Long NVDA 132.89

Short NVDA Oct 18 135 call -3.00 (credit)

Long NVDA Oct 18 130 put 2.65

Short NVDA Oct 18 120 put -.60 (credit)

Net cost 131.94

This combination would have a max upside of 3.06 (2.3%) and a downside of 1.94 (1.5%) for all stock prices above 120 at expiration. Below 120, there is additional point-for-point downside risk.

Naturally, a covered call write by itself, using the same 135 call offers more potential upside (3.9%). But it also comes with point-for-point downside beginning at the cost basis of 129.89. Using an ITM call such as the 130 would reduce the upside and lower the breakeven. Either of these covered call writes make for a relatively conservative strategy.

But if you believe a sharper selloff could be a possibility, or if you aren't going to be watching the markets closely, the put-spread collar offers another approach with even greater protection.

Different strikes and expirations on the put spread collar offer the flexibility to tailor the risk-reward further. For a 2.3% potential return in 9 days with extra downside protection, this collar would make a lot more sense to me than money market interest.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.