The Big Reveal: What Does That Mean for the Market?

September 19, 2024

The Markets at a Glance

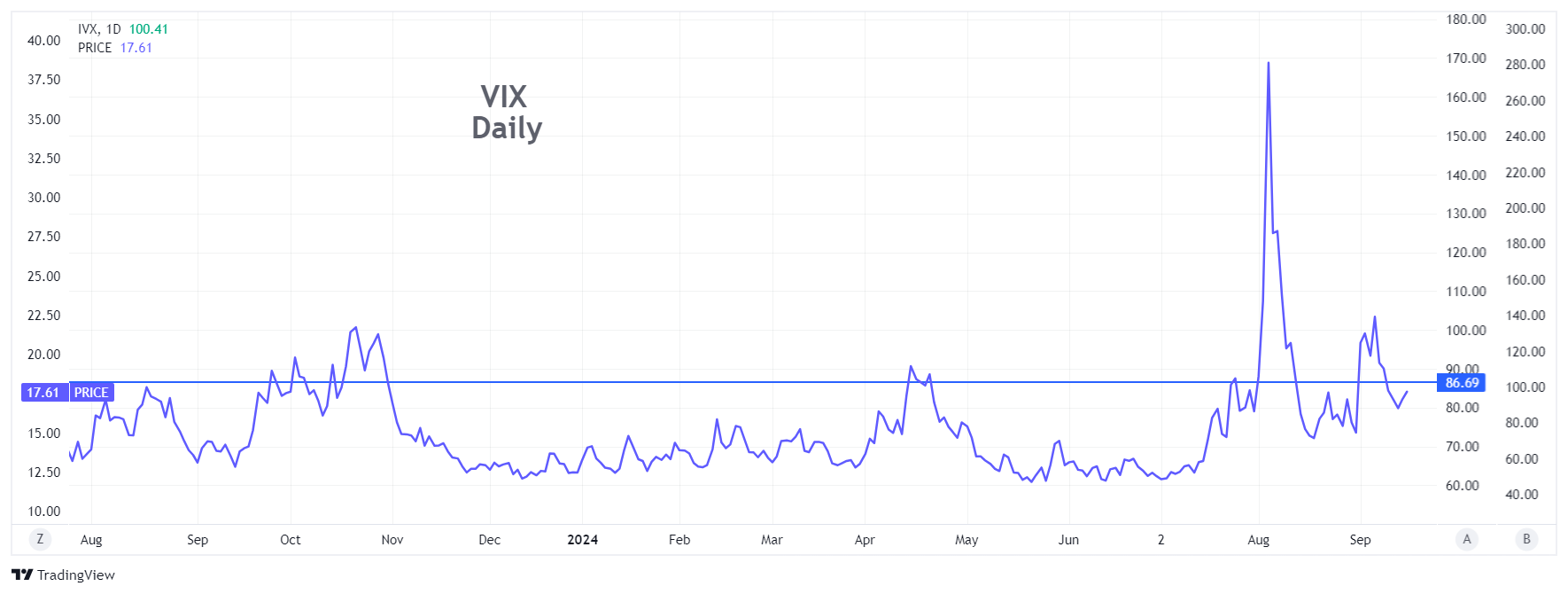

After all the overblown anticipation, Wednesday's "big reveal" was for a half-point rate cut. The media helped to put everyone on edge for weeks in advance as the sentiment wavered between a quarter-point and half-point cut in addition to which of the two would be more favorably perceived by investors. One could almost feel the tension with implied volatility rising and the rate policy sucking the media attention away from almost everything else in the room.

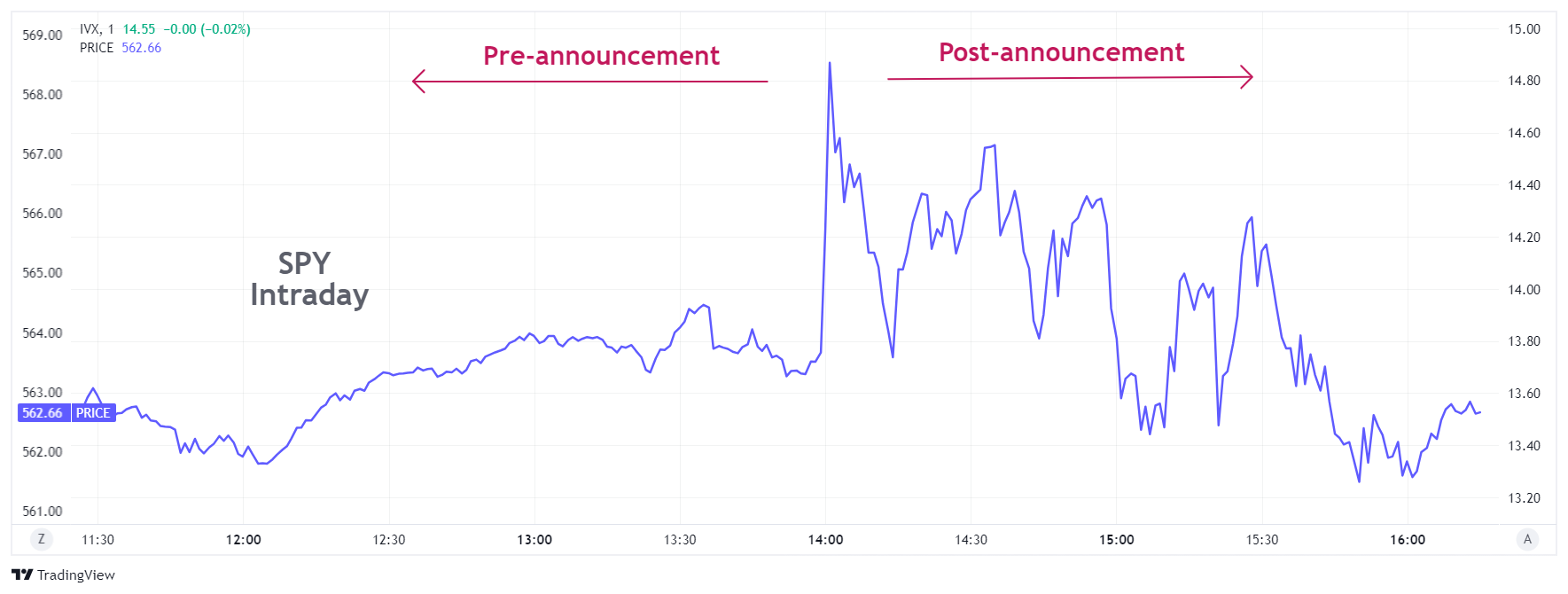

While SPY raced upward to a new high within seconds following the announcement, it closed at 561.36, down .30% from the prior day after changing direction numerous times during the two hours of trading following the announcement, as you can see on the intraday chart above.

Some of the back-and-forth action is no doubt the result of people listening to Powell's post-announcement remarks (which began 15 minutes later) and extracting clues as to the Fed's rationale for the cut and future expectations. But traders should also realize that some of the post-announcement volatility also comes from machine-driven trading and algorithmic trading which are now part of daily volume and which may not be reliable measures of true market sentiment.

VIX closed at 18.23, remaining somewhat elevated. There appeared to be a bit of a trading skew in SPY options expiring Wednesday (higher implied volatility for Wednesday, Thursday, and Friday options) than those of a month or two in duration. But I personally did not trade it as I deemed it was not compelling enough of a skew to take a chance.

As usual, the reaction to the announcement itself is only part of the overall effect the news will have on the markets. The reaction would have begun getting priced into securities as soon as the Fed indicated it was even considering a rate cut and will continue until everyone has digested the announcement and taken their intended actions.

That process unfolds over months with the day of the announcement representing only a small part of the overall move. It may well be, for example, that the August rally was, at least in part, an anticipation of the rate cut.

In addition, however, traders need to remember that the market's reaction is not solely the result of the Fed's intentions but will also be the result of economic numbers that follow over the next several months. Right now, the balance of opinion appears to be that the rate cut was the right move and will be good for the economy. But only the numbers of the next few months can bear that out.

So, between the economic reaction to the rate cut, the seasonal influences, and the upcoming election, I would expect VIX to remain elevated and for investors to be cautiously optimistic about stock prices for the coming weeks.

Strategy Talk: What Does the Rate Cut Mean to the Market in the Near Term?

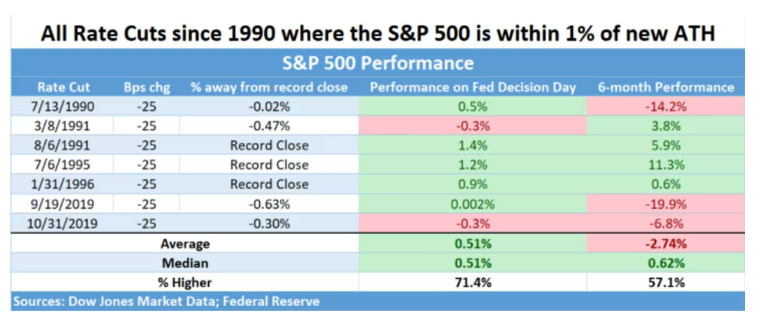

To gauge the potential effect over the next few months of the rate cut on stocks, it helps to have some perspective. I felt that a good presentation was made by MarketWatch on the historic reactions to rate cuts that were made when the market was at or near a record high level at the time.

From this data, we see a very mixed result, with a slight leaning towards a higher market on the day of the announcement but very mixed results over the ensuing six months. Given that, and the fact that low reactions on the day of the announcement generally signaled low reactions over the next six months, today's lower close does not tend to suggest a robust finish to the year.

In general, I would continue to take advantage of the higher IV by writing options and the fact that many of the popular tech stocks may be down off their highs to pick some up at good prices. As long as the economy does not indicate an impending recession, stocks should hold at reasonable levels here and move up toward year-end. Any weakness in the economy or added uncertainties in the election, however, will likely keep stocks from any significant gains in the next month or so.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.