More on Zero DTE Options

August 30, 2024

The Markets at a Glance

The SPY is holding near its high for the year after recovering most of the July decline. But the momentum is not yet there to set new highs, even with Nvidia (NVDA) beating its earnings estimates once again and raising revenue targets for the remainder of the year. That makes the current trend picture more or less flat for now, with an inconclusive medium term direction.

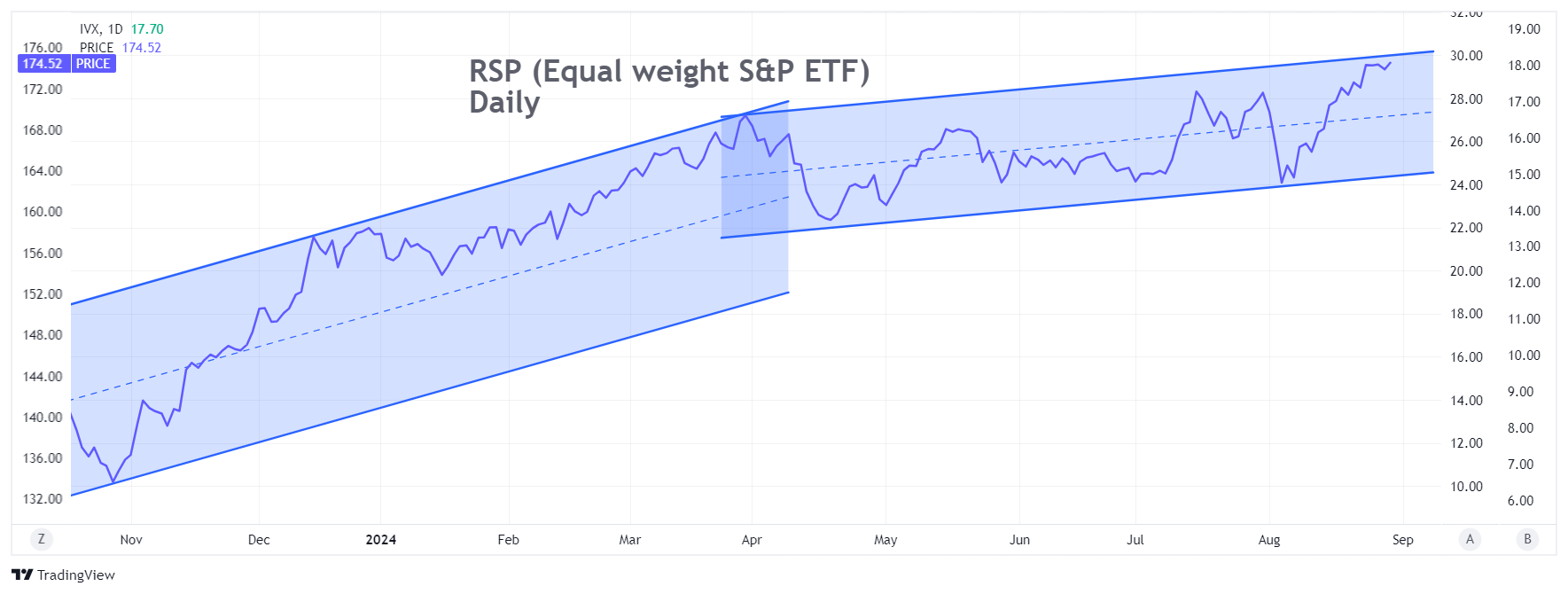

Meanwhile, the Equal Weight S&P ETF (RSP) did set a new high and appears to still be in a rising channel going back to 2023, albeit at a lesser slope since April. So the story from a few weeks ago about the uptrend broadening is playing out so far.

Implied volatility (VIX) remains in the mid-teens, which is somewhat non-commital. It means the scare about a recession that spiked VIX into the high 30s in early August may be off the table, but traders are not as complacent as they were this past Spring when VIX remained below 15 for months.

Given the history of Septembers and Octobers, I expect the market to continue meandering without too much conviction either way until the election. However, any weakness in the jobs picture or elsewhere in the economy could easily cause another spike in VIX and/or a decline in SPY.

My emphasis remains on covered call and put writing at present (which it admittedly does most of the time), but with the calls largely being written at ATM strikes to err on the side of a bit more downside protection.

Strategy talk: More on Writing One-Day Options

I spoke last week about writing options everyday on SPY or QQQ and I want to continue that discussion. Some people refer to one-day options trading as Zero DTE (days to expiration) trading. The Zero DTE traders don't limit themselves to SPY and QQQ. They consider trading any option on its last day as a Zero DTE trade. Because of all the weeklies that expire on Friday now, Fridays have become a hot day for single-day options trading.

If you do like to trade one-day-to-expiration options, I hope you play them from the short side, as going long on an expiring option is sure to be a losing strategy over time. If you do short options on their expiration day, here are a few tips from my own experience:

- Options on volatile stocks can carry time value right up to the close - sometimes a surprising amount. If you plan to purchase the option to close your position before the end of the day, you may have to pay more than you might like.

- In addition, buying options back in the closing minutes of trading means you are likely buying them from a market maker, who will need to hedge it. The ask price may not be to your liking.

- Lots of option activity occurs in the closing minutes before expiration. Market makers are actively hedging and unhedging their positions, which can result in unexpected last-minute moves in the stock price. (Mutual funds may also make unexpected end-of-day purchases or sales.)

- The options may stop trading at 4pm Eastern time, but stocks can potentially trade beyond 4 pm. A short option might be out of the money at 4 pm but then become in-the-money afterward and be assigned.

- News events sometimes occur after the closing bell, causing stocks to make unexpected moves.

- Most importantly! Shorting an option on its expiration day can result in your being tied to your screen all day and can wreak havoc with your head. Random moves can cause you to cover prematurely, become nervous, or even to panic. In short, you have to have the proper mindset for it and be prepared to be focused all day on market action.

I like one-day options, but I will only engage in covered writes or short puts on stocks I am prepared to own if assigned. Covered writing for a day (or two or three) can produce some nice profits on an annualized basis. If the stock rises above the strike near the close, you can just let it go (be assigned) or roll the option to the next expiration. And if the stock drops below the option strike, you may still even have some profit. This can be particularly attractive in accounts like IRAs with no tax consequences.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.