Treasury Bonds Higher Dollar Lower

November 21, 2022

The tide turned following the October CPI report on November 10. Markets sensed the era of out of control fiscal spending ended, at least for now, as inflation likely peaked in October, although the Federal Reserve plans to continue rising rates until they exceed a now declining inflation rate. Evidence comes from Treasury bond prices turning up and the U.S Dollar Index turning down.

Last week CPI Short Covering focused on equities, this week adds bonds and the U.S. Dollar to the unfolding turnaround story.

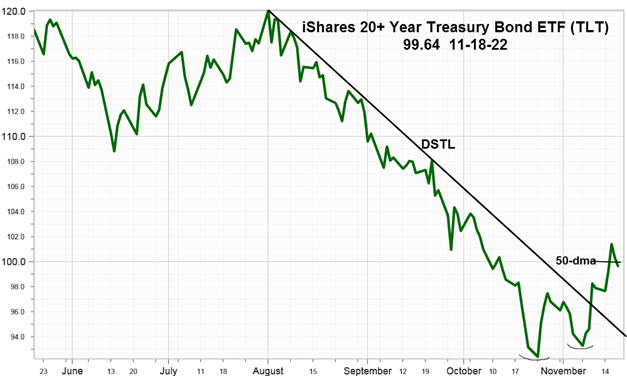

iShares 20+ Treasury Bond ETF (TLT) 99.64 advanced 1.75 points or +1.79% last week closing just below the 50-day Moving Average at 99.98 after reaching an intra-day high of 101.45 on Wednesday. However, it closed well above the downward sloping trendline (DSTL) from the August 2 high at 119.85 after making a double bottom, first at 91.62 on October 24, and then at 93.24 on November 7.

For the week the yield declined from 4.24% to 4.13% down 11 basis points as bond buyers' return seeking to lock in higher rates for the long-term along while traders seek short-term gains.

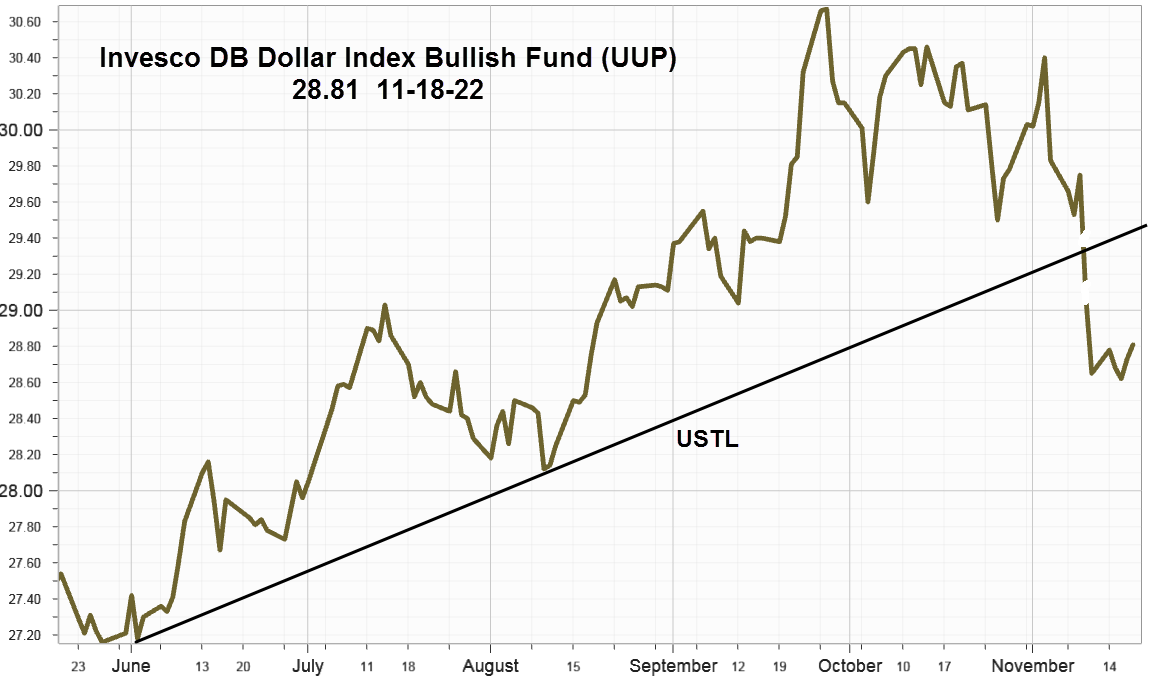

In addition, the U.S. Dollar Index (DX) supports the view that both bonds and equities bottomed after the October CPI report.

Invesco DB Dollar Index Bullish Fund (UUP) 28.81 +.16 point or +.56% last week. While the line on close chart below doesn't show the many gaps it creates, it does show the last two important ones as it broke below the upward sloping trendline (USTL). The first on November 10 as it declined .68 points or -2.29% and then next day November 11 as it declined another .42 points or -1.45%. See the UUP chart, a proxy for the U.S. Dollar Index.

While it could turn higher again if the November CPI report disappoints, for now the lower dollar supports advancing bonds and equities.

Summing Up

Last week the markets confirmed the view that the Fed may only increase the Funds rate by 50 bps in December. While the rate has yet to peak, multiple Fed officials emphasize "...ultimate level of interest rates will be higher than previously expected." The markets expect it to peak near 5% as inflation slows.

The S&P 500 Index stalled under resistance from the important 200-day Moving Average along with downward sloping trendline from the January high. Unless bonds and the dollar suddenly change direction, it will soon challenge resistance and determine if the October 13 low at 3491.58 marks the bottom.