Santa Claus Rally Is On

December 29, 2025

Market Roundup for the Week

Last week, the capital markets showcased a classic year-end "Santa Claus" rally. This seasonal period is defined as spanning the last 5 trading days of the current year and the first 2 of January of the new year. The rally is usually driven by optimism, holiday cheer and positive market outlook at the beginning of each new year.

This week, despite the thin holiday liquidity, there was surprisingly high conviction in the technology sector. Investor sentiment did remain cautious though perhaps due to persistent concerns about inflation the Federal Reserve's hawkish stance announced the prior week.

The primary driver for this performance was a "Goldilocks" set of economic data that balanced robust growth with cooling inflation. A standout third-quarter GDP revision showed the U.S. economy expanding at an annualized rate of 4.3%, significantly beating economist expectations. Despite this "hot" growth, the markets were buoyed by November's Consumer Price Index (CPI) coming in at 2.7%—lower than the 3.1% consensus. This data provided a sigh of relief for investors, reinforcing the narrative that the Federal Reserve's recent rate cuts are threading the needle between preventing a recession and curbing price pressures.

The week's action confirms that the "Path of Least Resistance" remains upward. However, the simultaneous record highs in Gold (GLD) and Equities (SPY) are a rare signal. It suggests that the market is "optimistically cautious"—betting on growth while bracing for the inflationary consequences of the Fed's easing cycle. Investors are chasing returns but they are simultaneously hedging against long-term geopolitical uncertainty.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The strategies can be scaled bigger (or smaller), according to individual account size.

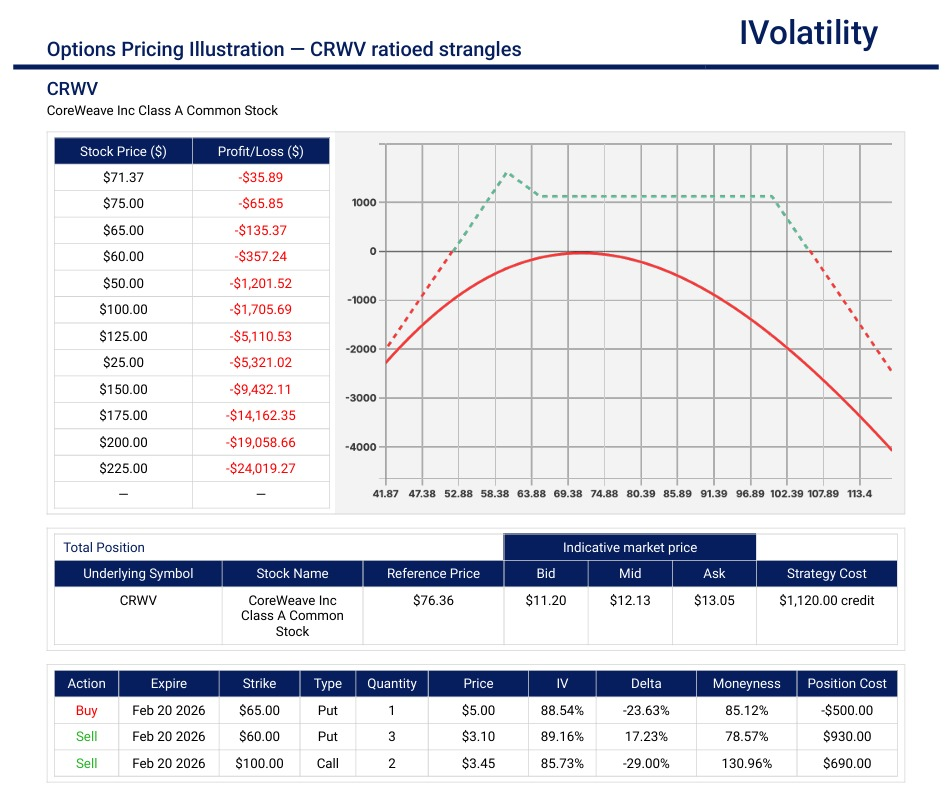

- CRWV (closed around 76.36 on Friday, Dec 26th)

Getting bullish on this underlying at this stage involves looking past its recent volatility and focusing on its role as the "backbone" of the AI infrastructure boom. While the stock has seen a sharp 44% pullback from its highs earlier this month, several high-impact catalysts suggest it could be a major runner in 2026. The company has massive revenue backlog, tier-1 partnerships and validation via government contracts.

So a trader could get bullish with ratioed strangles.

In the feb20 expiration cycle, buy one 65put / sell three 60puts / sell two 100calls.

Premium collected about $1200 / Buying power used up about $2000

Net position delta about -20

Probability of Profit about 70% / Breakevens around 51 and 106

This bi-directional strategy benefits from the underlying staying within the specified short strikes and can benefit even further in case of some continuing downside movement with the sweet spot right at 60 on expiration.

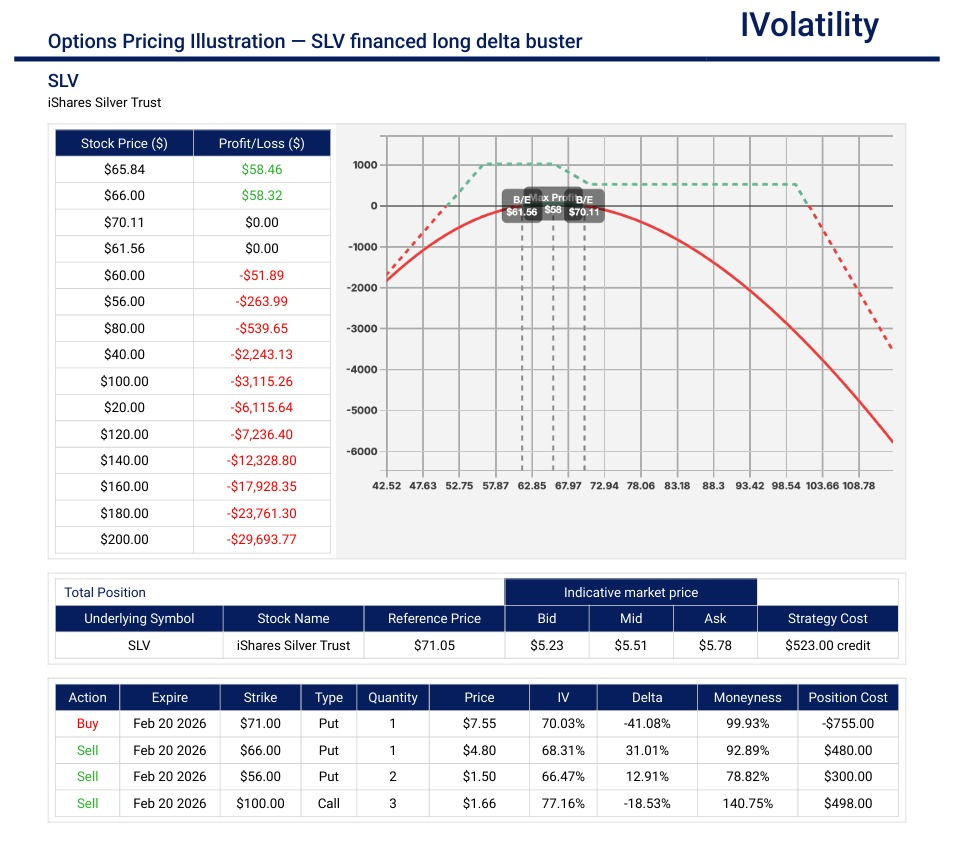

PnL Calculator from the IVolLive Web - SLV (closed around 71.12 on Friday, Dec 26th)

While the "silver squeeze" narrative has been incredibly powerful in 2025, taking a bearish (or at least cautious) stance on SLV at this point involves looking at the risks of a "blow-off top" and potential demand destruction. The underlying has extreme overbought technicals – SLV has enjoyed a near-parabolic run, up over 130% YTD. Historically, when a commodity moves this far, this fast, it becomes vulnerable to a "mean reversion."

So a trader could get bearish with a financed long delta buster.

In the feb20 expiration cycle, BUY one 71/66 put spread and finance the purchase with the SALE of two 56 puts and three 100 calls.

Premium collected about $560 / Buying power used up about $2400

Net position delta about -34

Probability of Profit about 80% / Breakevens around 51.5 and 104

PnL Calculator from the IVolLive Web

Movement of the Major Market Indices:

| INDEX | UP | DOWN |

| SPY | 1.4% | |

| QQQ | 1.11% | |

| IWM | 2.45% | |

| DIA | 1.23% | |

| GLD | 1.52% | |

| BTC/USD | 2.1% | |

| TLT | -4.14% | |

| Crude Oil | -2.5% | |

| VIX | -8.78% |

Movement of the Major Sectors:

| SECTOR | UP | DOWN |

| TECH (XLK) | 1.46% | |

| FINANCIALS (XL) | 1.88% | |

| INDUSTRIALS (XLI) | 2.05% | |

| ENERGY XLE | -1.25% | |

| HEALTHCARE (XLV) | 0.78% | |

| UTILITIES (XLU) | 0.55% | |

| MATERIALS (XLB) | 2.41% | |

| REAL ESTATE (XLRE) | 0.92% | |

| CONSUMER STAPLES (XLP) | 0.42% | |

| CONSUMER DISCRETIONARY (XLY) | 1.35% |

The significant outperformance of XLB and XLI suggests that the "soft landing" narrative has graduated into a "re-acceleration" narrative. Investors are no longer just hiding in Big Tech; they are buying the physical backbone of the economy.

Despite the broader market rally, XLE struggled significantly. This divergence highlights a "supply glut" concern in the oil markets that is currently decoupled from the optimism in the equity markets.

Traditional "safe havens" like XLP (Staples) and XLU (Utilities) saw very little inflow. In a week where the VIX dropped nearly 9%, the appetite for protection was at a yearly low.

Notable gainers for the week of Dec 15th - 19th:

Micron Technology (MU) gained 7% due to solid upward momentum on strong earnings expectations and positive sentiment around memory and AI-related demand for chips. Analysts and investors continued pricing in robust future performance, lifting the stock through the holiday week.

Nvidia (NVDA) gained 5% due to continued leadership in AI chips and semiconductor demand. Markets were buoyed by AI industry narratives and a reported licensing deal and asset acquisition from Groq, which reinforced long-term growth expectations in AI technology adoption.

SanDisk (SNDK) gained about 5% due to strength in memory and storage segments as server and component sales remained resilient, reflecting ongoing data center and AI infrastructure investments.

Freeport-McMoRan (FCX) rose 8% boosted by rising metals prices—especially copper reaching multi-year highs on supply concerns and global demand outlooks. FCX, a leading copper producer, benefitted directly from this commodity strength.

Notable losers for the week of Dec 15th - 19th:

Palantir Technologies (PLTR) dropped about 2.8% as profit-taking pushed it below a key technical support point.

D-Wave Quantum (QBTS) declined over 8% probably due to traders booking profits after recent strength.

Rocket Lab (RKLB) dropped 7% as traders booked profits from earlier highs and the market rotated toward other sectors.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets and News:

A short week and holidays on the horizon kept markets sedate all day long. Every sector in the S&P 500 except consumer staples rose today.

Bitcoin clawed its way back above $90,000 for a brief, shining moment before tumbling lower.

Gold and silver soared to new highs as geopolitical drama around the globe—including a car bombing in Moscow, US strikes on targets in Syria, and growing tensions off the coast of Venezuela—made traders jumpy.

Apollo Global is building up its cash reserves and fleeing risky assets as it prepares for volatility ahead.

"Big Short" investor Michael Burry won't stop taking swings at Nvidia—this time blaming its "power hungry" chips for thwarting the US's chances in the AI war.

Coinbase is acquiring prediction markets startup The Clearing Company as it continues to invest in the nascent industry.

Monday's Movers to the Upside:

- Tesla rose over 1.5% after a San Francisco power outage stalled Waymo's robo-taxis while Tesla's remained unaffected.

- Paramount Skydance rose over 4% after billionaire Larry Ellison's secured backing for its hostile bid for Warner Bros. Discovery.

- Rocket Lab jumped nearly 10% after winning an $816 million contract to build a missile-defense satellite constellation for the US Space Force.

- UniFirst popped over 16% after Cintas proposed to acquire the uniform rental company for $275 per share in cash.

- Stanley Black & Decker gained nearly 3.5% after agreeing to sell its aerospace manufacturing business to Howmet Aerospace for $1.8 billion, with proceeds earmarked for debt reduction.

- Investment management platform Clearwater Analytics climbed over 8% after agreeing to an $8.4 billion take-private deal led by Permira and Warburg Pincus.

- First Solar rose nearly 7% after Alphabet agreed to buy Intersect, one of First Solar's key solar-module customers, for $4.75 billion.

Monday's Movers to the Downside:

- Dominion Energy fell nearly 4% after the Trump administration halted the Coastal Virginia Offshore Wind project, the largest offshore wind project in the US.

- Aerospace product maker Honeywell dropped over 1.5% after announcing a $470 million litigation charge and issuing disappointing updated guidance.

- Maplebear slid 2% after Instacart said it would end all price tests following reports that identical items were being sold at different prices within the same store.

- Trump Media & Technology Group plunged over 10% amid ethics concerns tied to its recently announced $6 billion merger with TAE Technologies.

Tuesday's Markets and News:

Investors are heading into the Christmas holidays on a high note, with the S&P 500 ending the day at a record close.

Treasuries were flat for the day as traders balanced a strong GDP reading with the knowledge that the delayed report is probably a bit stale by now.

Tis the season to hop in the car for an extended road trip to visit extended family, so today's news that gas prices just hit a four-year low couldn't have come at a better time.

The US government announced new tariffs on Chinese semiconductor imports, but won't put them into effect until June 2027.

Airlines expect this holiday travel season to be the biggest yet as passenger count is very high despite higher airfares.

Beginning on January 7, the US government will begin garnishing wages of student loan borrowers to force them to pay back what they owe.

Tuesday's Movers to the Upside:

- Novo Nordisk surged over 7% after the FDA approved the first GLP-1 weight-loss pill.

- ZIM Integrated Shipping Services rose nearly 6% thanks to comments from the shipping service's board of directors that it's fielding multiple acquisition offers.

- Hycroft Mining climbed another 11% a day after its announcement that its mine in Nevada is yielding better results than anticipated.

- Unusual Machines climbed over 9% after the FCC banned drones and components from several Chinese manufacturers, citing risks to national security.

Tuesday's Movers to the Downside:

- ServiceNow dropped nearly 1.5% on the news that it will acquire cybersecurity startup Armis for $7.75 billion, its latest tie-up in a spate of deals.

- The Metals Company dropped over 5% on the news that regulators have opened the public comment period for the company's deep seabed mining exploration license applications.

- Asana plunged over 6% after COO Anne Raimondi revealed she's sold over 160,000 shares in the last few days.

Wednesday's Markets and News:

Markets were open for only half a day in observance of Christmas Eve.

Santa Claus is coming to town, and he's bringing a market rally. Despite a quiet day of trading, the S&P 500 rose to its first intraday record high since October, and closed at its 39th new all-time high of the year. The Dow also closed at a new record high.

Gold, silver, and copper kept their winning streaks alive, touching new highs yet again, while red-hot platinum took a turn for the worse.

Wednesday's Movers to the Upside:

- Nike (NKE) climbed over 4.6% after reports that Apple CEO, Tim Cook, nearly doubled his personal holdings of NKE stock. This purchase was obviously taken as a vote of confidence in the company's turnaround strategy.

- Dynavax Technologies (DVAX) shot up almost 40% after Sanofi announced a deal to acquire the company for around $2.2 billion, dramatically boosting its share price following the buyout news.

- Ramaco Resources (METC) jumped nearly 8% after announcing a $100 share buyback program which is generally interpreted as a signal of confidence from management.

Wednesday's Movers to the Downside:

- Intel (INTC) moved down just over 1% when reports surfaced that NVDA opted NOT to use its 18A chip manufacturing process. This cast a negative shadow on future foundry demand and weighed on the company's outlook for that segment of its market.

- Coinbase (COIN) dropped nearly 1% primarily due to softer cryptocurrency prices reducing trading volumes and weighing on sentiment towards digital-asset stocks.

Thursday's Markets and News:

Markets were closed for the Christmas Day holiday.

Friday's Markets and News:

Since 1950, December 26 has been the second-best day of S&P 500 returns for any given year. Not so for this year – stocks spent the day ebbing and flowing from positive to negative territory.

Silver climbed above $77 for the first time ever, while gold and platinum both hit new all-time highs of their own.

Friday's Movers to the Upside:

- Tesla (TSLA) was 3% to an all-time high based on investor optimism around long-term growth catalysts around robotaxi development. Several analysts raised price targets and that reinforced bullish expectations.

- IonQ (IONQ) rose nearly 8% following analysts initiating coverage and/or upgrading the stock with a strong price target.

- Circle Internet Group (CRCL) jumped nearly 10% mostly following Visa Corporation's announcement of using USDC (CRCL's stable coin) for bank settlements thus boosting demand for crypto infrastructure-related equities.

- Target (TGT) moved up over 3% after news came out that an activist hedge fund had built a significant position in the stock.

- Micron Technology (MU) had a significant up move of 7% due to continued enthusiasm around memory chips tied to AI and data center demand.

- Freeport-McMoRan (FCX) climbed over 2%, riding the coattails of the historic rally in precious metals and being a major player in copper and gold mining.

Friday's Movers to the Downside:

- Palantir Technologies (PLTR) dropped down almost 3% on no news. So, the move probably came from traders taking profits following big gains earlier in the month.

- Tesla (TSLA) moved down over 2% amid ongoing concerns unrelated to broader equity markets & including consumer/safety scrutiny and mechanical door release investigation by a U.S. regulator – which weighed on sentiment despite the holiday period.

- D-Wave Quantum (QBTS) moved down 8% after considerable profit-taking in a thin holiday session.

- Rocket Lab (RKLB) moved down 7% as traders rotated out of extended winners in a low volume holiday trading session.

Notable Earnings for week of Dec 22nd – 26th:

As is typical for the final week of the year, there are no notable or market-moving earnings reports scheduled for release from S&P 500 or blue-chip companies.

The primary reason for this vacuum is the "quiet period" before the Q4 2025/Full Year 2025 earnings season kicks off. Historically, the cycle begins in earnest during the second full week of January, led by the major money-center banks.

Even though the earnings calendar is empty, institutional investors often use this low-volume week to lock in tax losses or reposition for the "January Effect"—a historical tendency for stocks (especially small-caps) to rise in the first month of the year.

Notable Economic Data for week of Dec 22nd - 26th:

As we transition into the first trading week of 2026, the macroeconomic calendar is characteristically light due to a holiday-shorted week for the markets. However, the data that is scheduled to hit the tape will be pivotal for setting the tone for Q1, particularly regarding the health of global manufacturing and the Federal Reserve's private reflections on their recent policy shifts.

Tuesday: FOMC Meeting Minutes AND Chicago PMI (Dec).

The Federal Reserve will release the minutes from its December FOMC meeting. While the market has already digested the decision to hold rates steady at the 3.50%–3.75% range, investors will be scanning the text for "hawkish" or "dovish" nuances.

Any signal that the Fed is ready to resume cuts in early 2026 could provide further fuel for the equity rally.

Wednesday: China's NBS Manufacturing PMI (Dec).

As a major consumer of raw materials, any weakness in Chinese industrial activity could put further downward pressure on oil prices, which struggled to close out last week.

Friday: S&P Global Manufacturing PMI (Final).

Traders will get a clearer picture of whether the industrial sector is finally shaking off its 2025 lethargy.

Closing Thoughts

Retail traders love to bet on stocks, but their favorite way to play the market these days resembles a coin flip rather than an investment.

The acronym 0DTE stands for "zero days to expiration". 0DTE options are a special kind of contract that expire by the end of the day. With retail traders taking the market by storm, 0DTE options have surged in popularity. In fact, according to CBOE, over half of the S&P 500's daily options volume now comes from 0DTEs. While retail traders aren't the only ones using these options—pro traders use them to capitalize on short-term swings or to hedge positions—they're among the heaviest users.

Bloomberg reports that individual investors accounted for more than 30% of all options volume in 2025, with 0DTEs becoming the preferred investment option for retail traders. The surge of retail participation in markets, combined with the growing gamification of markets, makes it likely that the popularity of 0DTE options will continue to grow in the years to come.

Used smartly, they can offer excellent risk-reward, immediate and fast P/L response, are repeatable and have no overnight risk.

Used improperly, it might be considered gambling with leverage and account damage can be fast and often unrecoverable.

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.