Do We Hear Jingle Bells

December 1, 2025

Market Roundup for the Week

For Wall Street, the holiday-shortened Thanksgiving week was all about recovery. After slumping to a monthly low closing level on November 20, at which point the benchmark S&P 500 index was -4.4% for the month, the gauge posted a five-day win streak, which culminated on Black Friday with the S&P turning positive for the month. That swing from red to green was the largest ever for the month of November.

The first half of the week saw a risk-on rally that quickly propelled AI-linked stocks and specific retail names with strong earnings. This momentum, however, was countered by volatility in the latter half of the week (particularly in other software/cybersecurity names), leading to a selective market where good news was strongly rewarded.

But the mood swiftly improved over the week, chiefly due to economic data that has supported an interest rate cut in December. Historical patterns of trading have also played a part, with the widely held notion that markets tend to bottom on November 20 before the year-end Santa rally. The most significant risk to the cycle at this juncture is rising unemployment but subdued jobless claims alongside an expectation that monetary policy accommodation will generate increased hiring is supporting sentiment.

The mood among traders has definitely improved, chiefly due to economic data that has supported an interest rate cut in December. Odds of a December rate cut zoomed back over 70%. Historical patterns of trading also played a part, as markets are believed to generally bottom on November 20 before the year-end Santa rally.

Strategy Corner

Based on last week's market movements, here are some trading ideas and option strategies for the readers' consideration. The strategies can be scaled bigger (or smaller), according to individual account size.

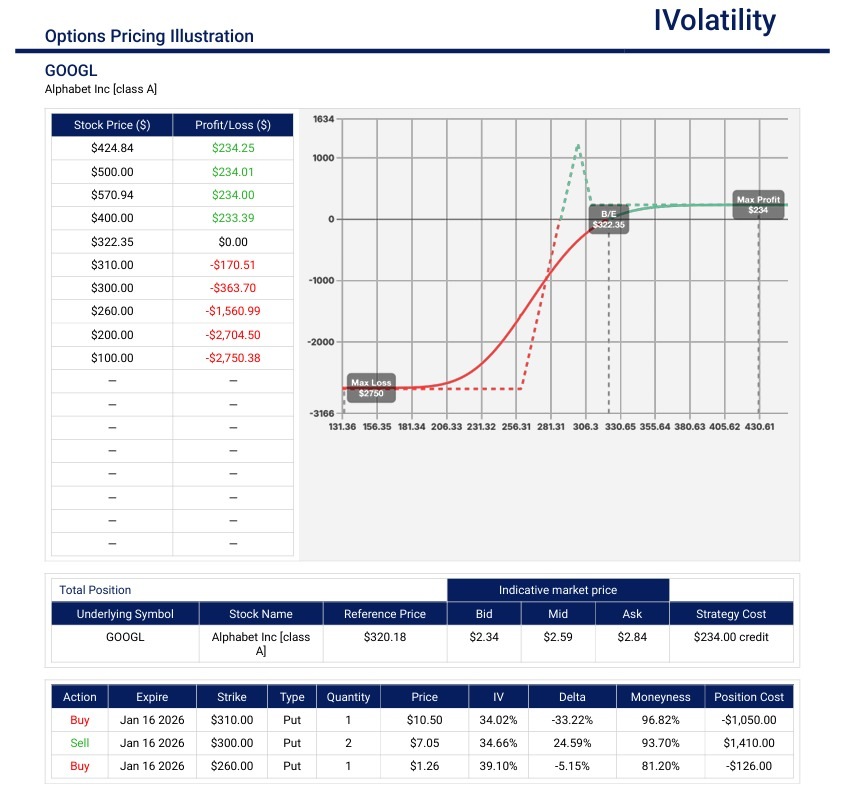

- GOOGL (closed at 320.01 on Friday, Nov 28th)

Following the revelation that Warren Buffet's fund made a substantial investment in this company, it experienced a big and sustained bump up in price. If a trader would like to get bullish, a put broken-wing butterfly could be a productive strategy. In the Jan16 expiration, buy ONE 310put / Sell TWO 300puts / Buy ONE 260put

Buying power needed about $2740

Credit collected about $260

Downside breakeven around 287; no risk to the upside

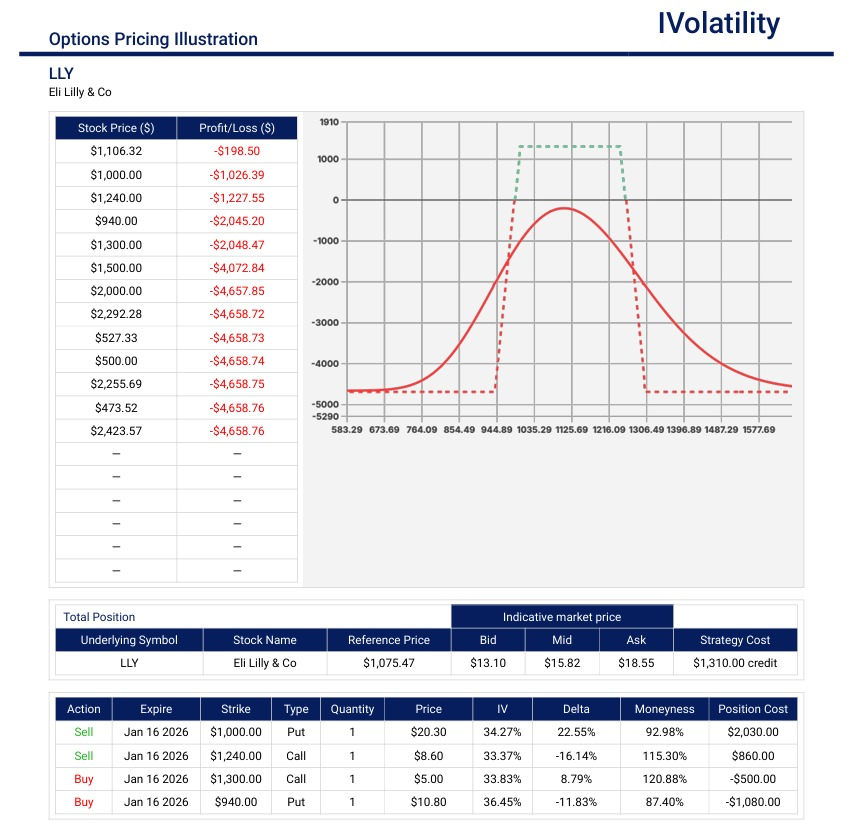

PnL Calculator from the IVolLive Web - LLY (closed at 1104.53 on Friday, Nov 28th)

This company recently reported blockbuster earnings and raised guidance. The strong results, largely fueled by demand for its weight-loss and diabetes drugs, led Lilly to raise its full-year guidance and analyst upgrades followed.

If a trader believes that this company will trade sideways for the next month or so, then an iron condor strategy might be considered.

In the Jan16 expiration, sell a neutral iron condor with shorts at 1000 and 1240 and longs at 940 and 1300 to limit buying power.

Buying power required is about $4400; Probability of profit is about 63%

Premium collected is about $1600

PnL Calculator from the IVolLive Web

Movement of the Major Indices:

These numbers are reporting the tradable activity from the opening on Monday, Nov 24th to the closing on Friday, Nov 28th (any gaps over the weekend are not included).

| INDEX | UP | DOWN |

| SPY | 3.7% | |

| QQQ | 4.9% | |

| IWM | 5.5% | |

| DIA | 3.2% | |

| GLD | 3.5% | |

| BTC/USD | 7.1% | |

| TLT | 0.29% | |

| Crude Oil | 2.43% | |

| VIX | -28.34% |

Movement of the Major Sectors:

| INDEX | UP | DOWN |

| XLK | 4.3% | |

| XLF | 3.2% | |

| XLV | 1.9% | |

| XLY | 5.3% | |

| XLI | 2.7% | |

| XLP | 1.7% | |

| XLE | 1.28% | |

| XLU | 2.65% | |

| XLB | 3.3% | |

| XLRE | 1.78% |

Notable S&P gainers for the week of Nov 24th - 28th:

The trading week of November 24th through November 28th, 2025, was shortened due to the Thanksgiving holiday (markets closed Thursday and closed early Friday). The week started with a massive rally, largely driven by enthusiasm over AI developments and specific earnings beats. While volatility returned mid-week, the biggest gainers came from a mix of mega-cap tech, retail, and biotech stocks. Several key retailers saw massive, double-digit gains following their earnings reports, suggesting the holiday consumer may be more resilient than feared in certain segments.

Alphabet: The stock hit a new all-time high, driven by continued positive analyst reaction to the previous week's launch of its Gemini 3 AI model.

Broadcom Inc: Shares soared (over 11% on Monday alone) after reports highlighted its role as a significant supplier of chips to Alphabet's massive AI infrastructure buildout, reinforcing its exposure to the "AI wave."

Robinhood Markets: jumped nearly 11%, boosted by an announcement of expansion into prediction markets.

Abercrombie & Fitch: Shares surged over 35% after reporting a significant beat on quarterly results and offering a strong outlook for the holiday season, reversing investor pessimism.

Kohl's Corp: Stock jumped over 40% after releasing quarterly results that exceeded expectations, calming fears about department store performance.

Ross Stores Inc: Gained roughly 9% for the week, benefiting from strong earnings and a positive outlook for the value-focused retail segment.

Best Buy Co: Shares rose after reporting better-than-expected sales, revenue, and profit, and raising its full-year outlook, pointing to consumer resilience in the electronics sector.

Oscar Health: Shares surged (over 20%) following a report that the White House was considering a potential extension of Affordable Care Act subsidies, which would significantly stabilize the company's core business.

IDEXX Laboratories: Posted a very strong gain for the week (over 12%), demonstrating significant momentum, though often less tied to daily macro news.

Merck & Co: Posted a solid gain (over 8%) for the week.

Notable S&P losers for the week of Nov 24th - 28th:

The trading week of November 24th through November 28th, 2025, was shortened due to the Thanksgiving holiday (markets closed Thursday and closed early Friday). While the overall market indices (S&P 500, Nasdaq) ended the week in positive territory, a dramatic sell-off in specific high-growth sectors created several notable losers.

Despite the overall positive mood of the indices, the week was dominated by selective selling. Capital flowed out of stocks with high valuations and uncertain profit outlooks (especially in Tech/AI and Discretionary) and into more stable areas of the market.

The primary driver of the losses was the continuation of the "AI valuation fear" and negative reaction to some high-profile earnings.

Zscaler Inc: The cybersecurity stock fell sharply (over 8.5% for the week) following its quarterly earnings announcement after the close on Tuesday, Nov 25th, despite overall strong monthly losses.

Super Micro Computer Inc: Continued a steep monthly decline as market skepticism grew over the sustainability of extreme AI-driven valuations, making it one of the largest losers in the tech sector for the entire month.

Advanced Micro Devices: Fell as part of the broader cooling of the AI and semiconductor rally, despite a positive reaction to Alphabet's AI news early in the week.

Oracle Corp: Suffered a significant monthly decline (and continued weekly weakness) as investors questioned its reliance on key AI partnerships (like OpenAI) for future growth.

Deere & Co: The agricultural and heavy equipment manufacturer reported earnings on Wednesday, November 26th, and saw its stock price fall (around -4.7% for the week) as the market reacted negatively to its forecast or operating margins.

Tilray: Finished the week as one of the single worst-performing US-listed stocks covered by analysts, falling over 10%. Often driven by volatility specific to the cannabis sector and broader risk sentiment.

Warner Music Group: Fell roughly 8% for the week, often reacting to specific industry news or concerns over streaming revenue growth and competitive pressures.

Review selected market indices below:

Daily Notable Market Action

Monday's Markets and News:

Two central bankers have now called for a rate cut in December, giving investors hope heading into the holidays. So the December rate cut is back in play and odds jumped from 42% to 80% in one week.

That was enough to push markets squarely into positive territory to kick off the shortened work week on a high note. The bleeding in technology stocks took a break and Nasdaq had its best day since May after all of the Mag 7 companies rallied, pulling the rest of the tech sector higher with them.

The good vibes trickled down to gold and crypto alike, with bitcoin inching its way back toward the key support level of $90,000.

Alphabet added close to $250 billion after launching Gemini 3, but the real story was heard from their infrastructure chief who said that the company needs to double its compute capacity every six months just to keep up.

Telehealth startups are now pitching "microdosed" GLP-1 drugs to consumers as cosmetic enhancements instead of medical treatments.

Amazon announced it will invest $50 billion in AI infrastructure for US government agencies.

Spotify announced increases in subscription prices and consumer confidence hit its lowest point since April.

Monday's Movers to the Upside:

- The AI group caught a bid with Broadcom rising 11%, Micron Technology gaining almost 8%, and Nvidia rallying just over 2%. Investors see Broadcom as a safer bet on Google's AI push.

- Alphabet was up nearly 7%. It is now $230 billion away from a $4 trillion market cap and closing in on Apple. Warren Buffett's Berkshire bought 17.8 million shares earlier this month. The company last held the number two spot in 2018.

- Oscar Health led insurers higher, rising nearly 23% on reports that President Trump will propose a two-year extension of Affordable Care Act subsidies.

- Tesla added nearly 7% as CEO Elon Musk revealed on X that the company is finalizing its A15 AI chip and starting work on A16. The chips power both Tesla vehicles and data centers.

- Inspire Medical Systems skyrocketed over 30% following a ratings upgrade from Stifel, which highlighted a favorable reimbursement update.

- Bayer climbed over 8% after announcing that a late-stage trial for its stroke drug succeeded, a result that also lifted rival Bristol Myers Squibb by over 3%.

Monday's Movers to the Downside:

- Grindr tumbled over 12% after announcing that its board ended discussions with two board members regarding their non-binding $18/share takeover proposal.

- Arcellx declined nearly 17% after rival biotech Kelonia Therapeutics released encouraging early-stage data for its experimental blood cancer treatment peace deal that sent crude prices tumbling, while copper prices jumped.

Tuesday's Markets and News:

Only a few weeks ago, investors were fretting about the AI bubble bursting. But the AI trade is back in full swing thanks to Alphabet (more on that in a moment) and rising hopes of a rate cut in December; both helped push stocks higher.

The 10-year yield fell on reports that White House National Economic Council Director Kevin Hassett has emerged as the favorite to replace Jerome Powell.

Tuesday's Movers to the Upside:

- Zoom Communications popped 10% after boosting its earnings outlook, lifted by steady hybrid-work demand and growing adoption of its AI-enhanced tools.

- Analog Devices gained just over 5% on strong fourth-quarter results, with revenue climbing 26% despite tariff uncertainty and mixed semiconductor demand.

- Applied Materials rose 5% after UBS upgraded the stock to "buy" and lifted its price target, citing expectations the company will outpace the broader wafer-fab equipment market over the next two years.

- Symbotic climbed nearly 40% after reporting 26% year-over-year revenue growth and an expanded product lineup.

- Pony.ai advanced nearly 6% as the autonomous-driving company delivered strong third-quarter results and announced plans to scale its robo-taxi fleet in China.

- Barnes & Noble Education ticked up over 36% after projecting $1.6 billion in preliminary fiscal 2025 revenue, a 2.6% increase from last year.

Tuesday's Movers to the Downside:

- Alibaba lost nearly 2.5% despite reporting that its cloud-computing revenue surged 34%year over year in the fiscal second quarter, beating expectations.

- Burlington Stores dipped over 12% as weaker-than-expected third-quarter sales overshadowed an earnings beat.

- SanDisk fell nearly 3% despite news the company will join the S&P 500 on Nov. 28, replacing Interpublic Group in the index.

Wednesday's Markets and News:

Investors headed into the holiday in a good mood, with a strong showing from tech stocks propelling indices higher across the board. The S&P 500 climbed back above its 50-day moving average, while the CBOE Volatility Index posted its steepest decline since April.

Oil inched higher as traders awaited word of a peace deal between Ukraine and Russia, while gold climbed as hopes of a rate cut next month continue to grow.

Bitcoin clawed its way back above $90,000 at one point today, and while it sank lower, it still managed to retain some gains.

The market is now pricing in about an 83% chance of a rate cut in December, up from around 50% just a week ago.

An MIT study found that AI could already replace over 11% of the US workforce.

It is reported that OpenAI won't make money by 2030.

Wednesday's Movers to the Upside:

- Arrowhead Pharmaceuticals jumped over 23% as fiscal-year revenue beat expectations, helped by momentum from its treatment for familial chylomicronemia syndrome, the first and only treatment on the market.

- Dell Technologies gained nearly 6% as investors looked past a revenue miss and focused on the company's stronger fourth-quarter outlook tied to AI demand.

- Autodesk rose nearly 2.5% on better-than-expected third-quarter results and an upward revision to its full-year guidance.

- Petco Health & Wellness soared over 14% after reporting its second straight quarterly profit and raising its profit outlook for the year.

- CleanSpark advanced nearly 14% as the bitcoin miner doubled its 2025 revenue and outlined plans to position its power portfolio for AI-driven data-center growth.

- Robinhood Markets surged nearly 11% after revealing it will launch a futures and derivatives exchange alongside Susquehanna International Group as it expands its footprint in prediction markets.

Wednesday's Movers to the Downside:

- Cloud security company Zscaler fell over 13% as a miss on billings outweighed a top and bottom line beat.

- Nutanix slipped nearly 18% after the cloud software company missed both its first-quarter revenue and second-quarter outlook.

- PagerDuty dropped over 23% as stronger earnings couldn't offset a sales miss.

- Workday declined nearly 8% following disappointing third-quarter results and analyst price-target cuts tied to weaker subscription revenue guidance.

- Semiconductor design company Ambarella sank nearly 19% despite beating on earnings, with investors reacting to a decline in gross revenue and a GAAP loss for the quarter.

Thursday's Markets and News:

US capital markets were closed for the Thanksgiving holiday.

Friday's Markets and News:

Friday was a shortened trading day for the US stock market (closing at 1:00 p.m. ET). Trading activity was relatively light, with focus primarily on early reactions to Black Friday sales reports.

Despite the short session, several notable companies moved up significantly, largely continuing the positive momentum seen in the Retail sector following strong earnings releases earlier in the week and driven by high hopes for a successful holiday spending season.

Yet, despite the major indices closing higher, a few notable companies moved down. These losses generally reflected a cooling-off period for the most aggressive growth stocks and some continuation of the valuation concerns that had plagued the sector throughout November.

The market's most aggressive growth stocks were the primary laggards, suggesting profit-taking and caution over high valuations persisted, even on a bullish day.

A notable event this week was when investors returned from the Thanksgiving holiday on Black Friday to find trading across futures markets halted for several hours. The issue arose after the CME Group, the world's largest exchange operator, suffered an outage due to a cooling issue at some of its data centers. Trading was eventually restored, and the truncated Black Friday regular session had no further problems.

Friday's Movers to the Upside:

- Tesla: Moved up strongly on the short day, benefiting from broad market confidence, particularly as optimism around consumer spending and electric vehicle demand continued into the Black Friday weekend.

- Ulta Beauty: The specialty retailer saw its stock rise, reflecting positive sentiment across the retail sector and strong initial Black Friday traffic/sales projections.

- Lowe's Companies: Gained ground, often trading in sympathy with consumer discretionary stocks and a general bullish sentiment on home improvement sales during the holiday weekend.

- Amazon: As the largest e-commerce beneficiary of Black Friday and Cyber Monday, the stock traded higher on expectations of record online sales during this key shopping period.

- Microsoft: Showed a modest gain, continuing its positive run as investors remained bullish on its cloud business (Azure) and its dominant position in the AI landscape.

Friday's Movers to the Downside:

- Nvidia: The chipmaker saw its stock fall nearly 2%, making it one of the largest decliners in the Nasdaq and Dow components for the day. This slide continues a pattern of investors taking profits after any major AI-driven rally, showing apprehension over whether the valuations are justified.

- Oracle: Shares slipped about 1.5% lower extending a sharp, double-digit monthly decline. Investors have been scrutinizing the company's aggressive cloud expansion and its reliance on commitments from major AI partners like OpenAI to hit future business targets.

- Palantir Technologies: Suffered losses, reflecting the broader market's increasing attention to the high valuation multiples of companies tied to AI and defense software.

- Eli Lilly: Shares slipped about 2.5% giving back a portion of the significant recent gains that had propelled the pharmaceutical company to a trillion-dollar market capitalization. This was likely a rotation out of a heavily-performing stock, though its long-term growth story driven by weight-loss drugs remains robust.

Notable Earnings due week of Dec 1st - 5th

The actual day may vary, so do consult with your broker to confirm the actual date. Also, if an options trader wishes to open positions to participate in earnings announcements, its important to check whether the earnings are released BEFORE or AFTER the date of earnings.

Monday: CRDO / MDB /

Tuesday: CRWD / MRVL / OKTA / GTLB /

Wednesday: CRM / SNOW / DLTR / AI / M / UPATH /

Thursday: LULU / DOCU / DG / HPE /

Notable Economic Data due week of Dec 1st - 5th

While corporate earnings are light, December 5th is scheduled to feature the release of several critical pieces of economic data for the US, which will likely drive market movement more than any single earnings report.

Given the timing, the market on December 5th will likely be driven more by the inflation and consumer spending data releases than by the single retail earnings report.

PCE and Core PCE: The Personal Consumption Expenditures (PCE) Price Index is the Federal Reserve's preferred measure of inflation. The report for September is highly anticipated due to recent data delays.

Personal Income and Spending: Gives the market a clear picture of consumer health following the Thanksgiving holiday.

Factory Orders: A measure of demand for durable and non-durable goods, indicating the health of the manufacturing sector.

Closing Thoughts

What does A-L-P-H-A-B-E-T spell? C-O-M-E-B-A-C-K?

The AI race isn't over yet... It might be Sagittarius season right now, but in the tech world, this month has been all about Gemini.

Very recently Alphabet launched its new chatbot, Gemini 3, which impressed users and is reportedly superior to its peers like ChatGPT and Perplexity. Then soon after, Alphabet launched the latest version of its image generation program, dubbed Nano Banana Pro.

The grand finale appears to be a report that Meta Platforms is in talks to use Google's chips, which pushed Alphabet another nearly 2% higher.

When ChatGPT dropped back in 2022, many analysts argued Google had blown its search lead, given OpenAI's prowess. But part of what has helped Google get its mojo back is its full-stack advantage – it not only makes a range of software platforms to market and distribute Gemini, but also designs its own chips.

Some of those chips, called tensor processing units, or TPUs, may allow companies like Meta to power their AI at a lower cost than Nvidia's GPUs. If that proves to be the case it would be a major blow to Nvidia, and underscore that Google is making strides on both the software and hardware fronts.

At the same time that the new and improved Gemini wooed investors, it sent shares of competitors tumbling. SoftBank, a major investor in privately-owned OpenAI, fell nearly 11.5% and is now down over 36% over the last month. Meanwhile, Nvidia sank nearly 3%, wiping out roughly $243 billion in market value, according to Bloomberg.

Nvidia praised Google's strides but also made it clear as to who's the boss: "NVIDIA is a generation ahead of the industry – it's the only platform that runs every AI model and does it everywhere computing is done."

Nvidia may be the name most associated with the AI trade, but in fact, Alphabet has been the best performing Mag 7 stock this year: It has surged nearly 70% in 2025, compared to Nvidia's approximate 33% gain. Last Friday, Alphabet surpassed Microsoft to become the third most valuable US firm by market cap, and it's now only a few billion behind second-ranked Apple.

At this rate, how long can Nvidia keep the status of the big kahuna of the AI trade??

Questions / Comments

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use support@ivolatility.com.

Previous issues are located under the News tab on our website.