INSIDER TRADING: Unusual Options Activity on April 9th, 2025

April 25, 2025

Overview

This report investigates suspicious trading activity in SPY 0DTE (zero days to expiration) call options on April 9th, 2025. We examine anomalies in volume and timing that suggest potential insider trading, particularly in relation to an unexpected public announcement by President Donald Trump.

Key Observations

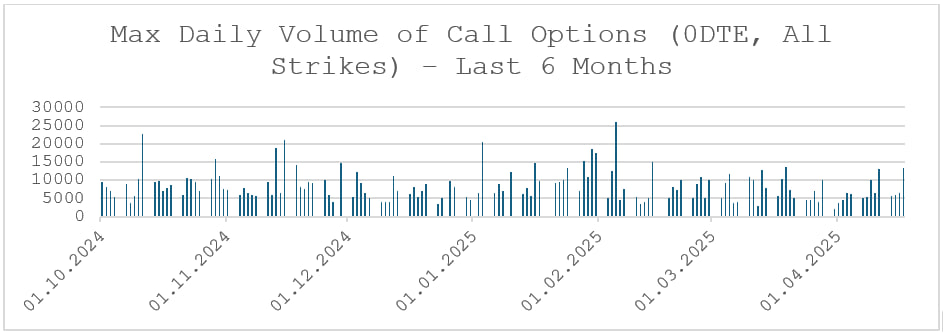

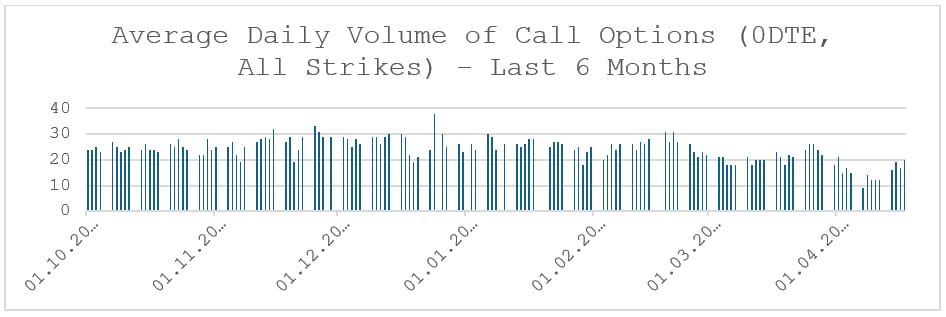

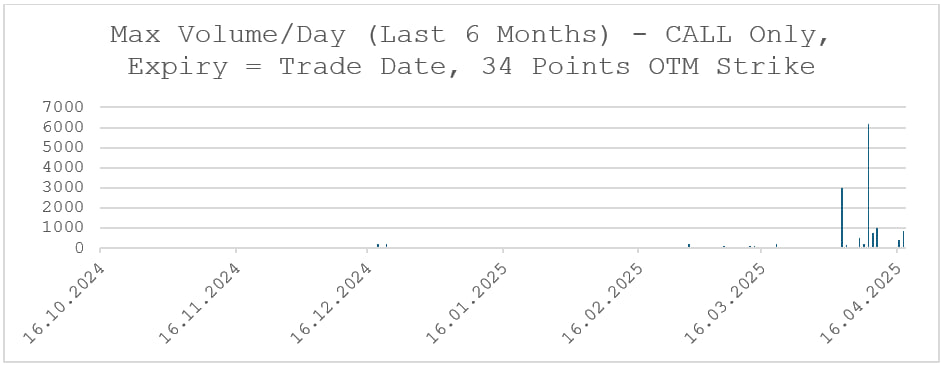

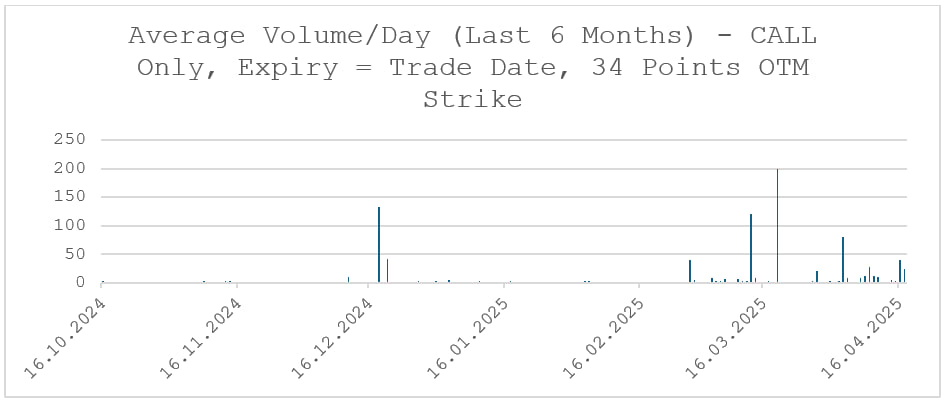

First, we compare April 9th data to six-month averages:

- Average maximum daily call option activity over six months: 8,447

- Maximum activity on April 9th: 10,009

- Average daily volume over six months: 24

- Average volume on April 9th: 12

Despite higher peak activity, the average trading volume on April 9th was 50% lower than the six-month average. This contrast suggests a concentration of trades rather than a general increase in market interest – often a red flag.

Suspicious Timing and Volume

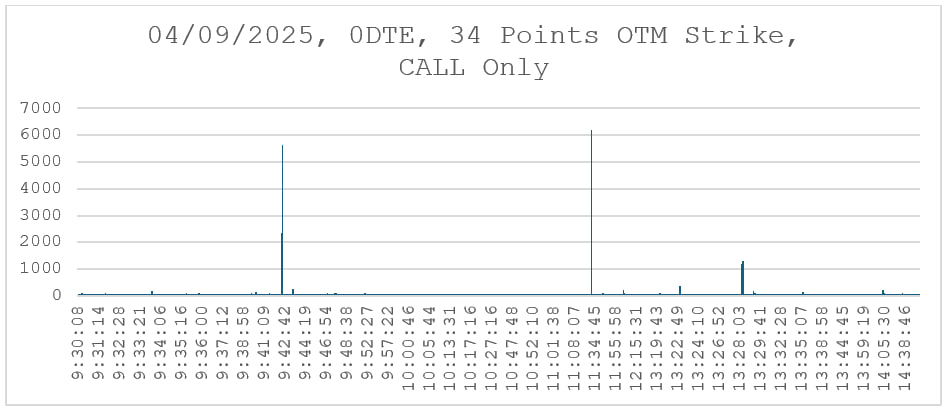

Our focus is on SPY call options, specifically at strikes located 34 points above the underlying asset's price. These out-of-the-money (OTM) options serve as a useful lens to identify trading behavior outside of standard market patterns.

A closer look at strike prices 34 points OTM reveals two significant trades, each for approximately 6,000 contracts, executed at 09:42 and 11:30.

Crucially, President Trump's announcement occurred at 13:19, well after these trades were executed. When measured against a six-month span of trading data, these were the largest single-volume trades observed at these strikes.

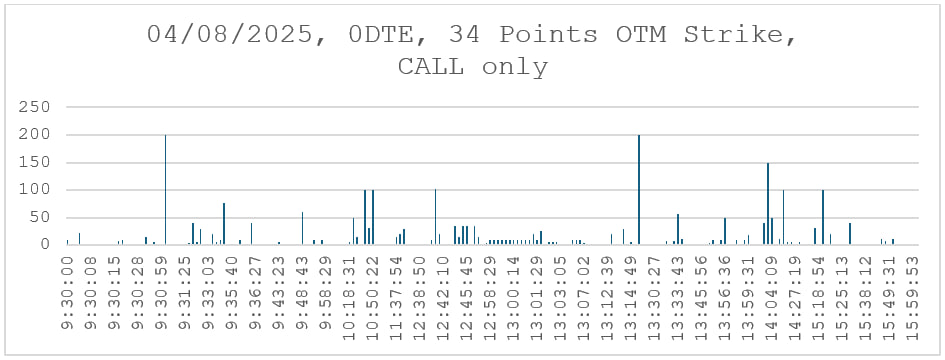

For context, the chart from April 8th shows no such irregularities:

Market Comparison

While April 9th did not see a substantial rise in overall trading volume, the size and timing of the trades stand out. The only comparable event was on April 3rd, when overall volumes were three times higher, indicating a more balanced and active trading environment. April 9th's selective and concentrated volume spike suggests an intentional move rather than market-driven interest.

Conclusion: Evidence of Insider Trading?

Based on volume patterns, trade timing, and alignment with market-moving news, we believe there is credible evidence to suggest insider trading occurred on April 9th, 2025.

What is Insider Trading?

Insider Trading refers to the act of trading a publicly traded security based on material, non-public information.

- Insider: Anyone with access to confidential information not available to the general public

- Material Information: Information that would influence investment decisions (e.g., earnings reports, mergers, product recalls)

- Legal Insider Trading: When strict regulatory rules are followed and reported to the SEC

- Illegal Insider Trading: When positions are opened or closed before the information becomes public

Why it matters: Illegal insider trading creates an uneven playing field, damages investor confidence, and is classified as fraud – punishable by fines or imprisonment.

Spotlight: 0DTE Options

0DTE options are contracts that expire the same day they are traded. They are popular for capitalizing on intraday moves in major indices, particularly the S&P 500 (SPX/SPY).

- Long positions (calls/puts): Can multiply in value within minutes

- Short positions (calls/puts): Capture premium quickly

- Volume impact: SPX 0DTE options can account for over 40% of total SPX option volume

Their extreme sensitivity to price and time makes them a perfect instrument for traders with privileged knowledge to profit quickly – and quietly.

Final Thoughts

The activity observed on April 9th aligns with classic indicators of insider trading. While regulatory bodies will ultimately determine the legality of these trades, the data raises serious concerns.

We Want to Hear From You

At IVolatility, we're committed to keeping our users informed and empowered. If you have questions about this report or any options strategies, we'd love to hear from you.

- Email us at: support@ivolatility.com

- Explore past insights: Visit the Trade Ideas tab on our website.

Disclaimer

This material is provided for informational and marketing purposes only and does not constitute investment advice or a recommendation. IVolatility.com and its partners are not responsible for decisions made based on this information. Trading involves risk, including the potential loss of capital. Past performance is not indicative of future results.

Previous issues are located under the Trade Ideas tab on our website.