VIX is at a Four-Year Low

May 22, 2024

The Markets at a Glance

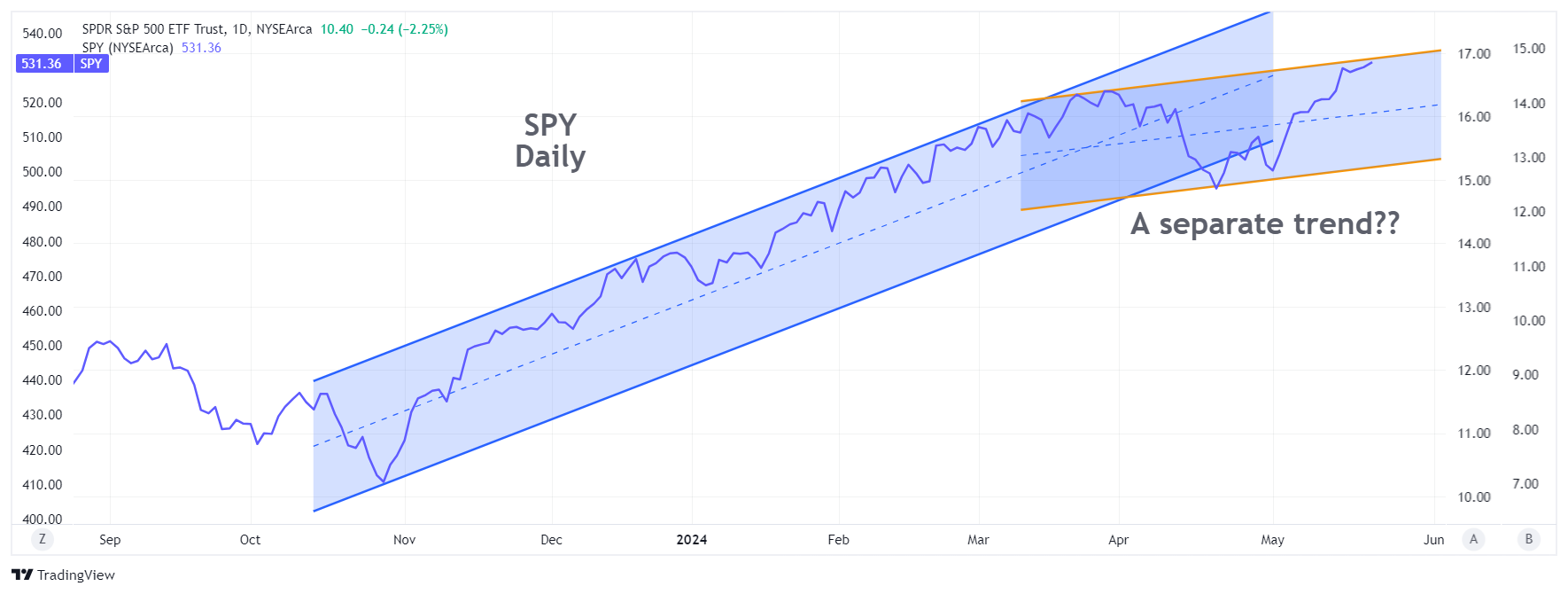

SPY and QQQ continue to make new highs, though you may now notice that the trend since the previous high in April appears to be shallower than the one that brought the market to the 2024 April high from the 2023 October low. To many, this may seem like splitting hairs, but to a market technician who has followed trends for more than 30 years, a change in slope is meaningful to the character of a trend.

Slope changes are not that uncommon as a long trend matures. The market still wants to climb but it just can't do so with the same vigor as it has been exhibiting up to that point. Most of the time a change in slope is to a lesser one as a trend simply begins to exhibit exhaustion. Occasionally, however, the slope will increase or accelerate in the middle of a trend. While this is rare, it is usually the result of broad and significant new information that is sufficient to increase an existing trajectory (or accelerate a downtrend move).

An acceleration downward occurred in 2008 when the real estate crisis widened, brokerage firms started going bankrupt, and people began to fear a systemic breakdown rather than just a run-of-the-mill correction.

A change in slope is important to traders looking to buy near the trend's low points and sell near the upper points. From the chart of SPY above, I see the SPY as having changed slope with the April correction and subsequent May advance. So, while I still see us in an uptrend, I view the current position quite differently than someone who is merely projecting the original trend. That would produce a much higher target for the near term. In contrast, I see us having reached the upper trend boundary and expect another pullback shortly.

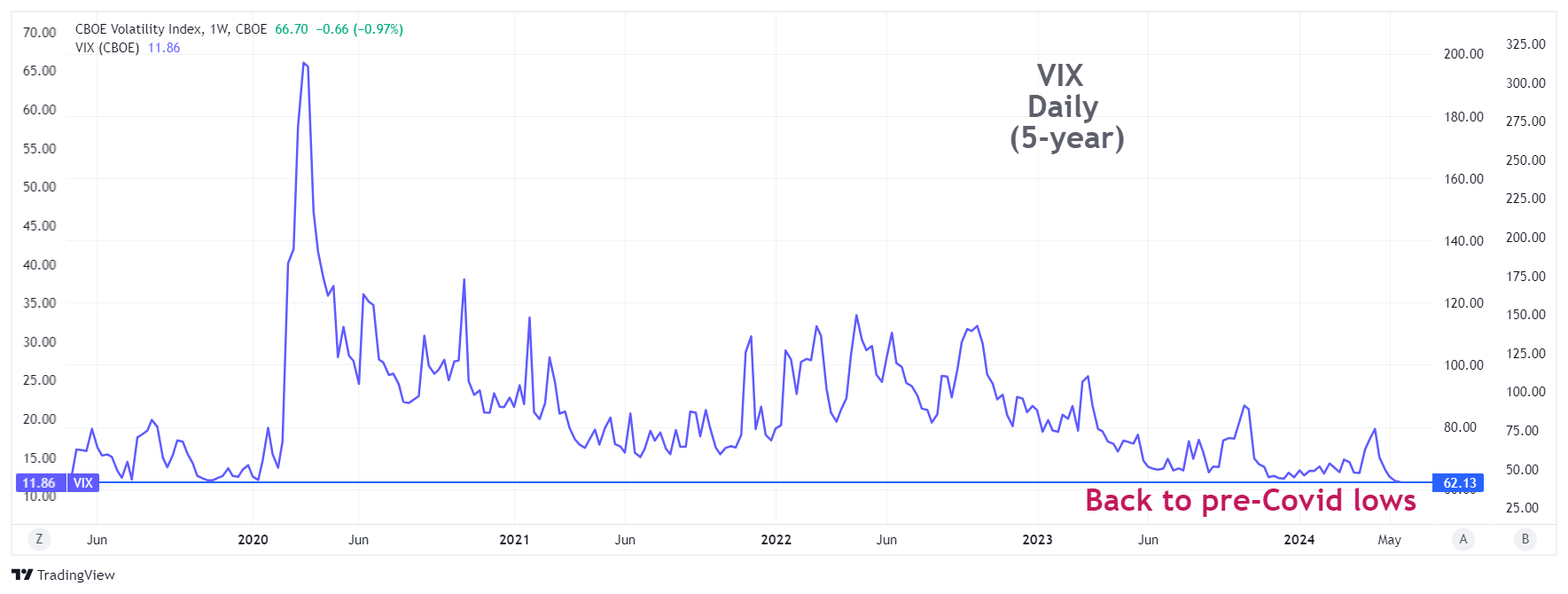

Either way, VIX has dropped to new lows. It is easy to cast off the low in implied volatility as an expected accompaniment to a market that is well into a 7-month uptrend and doesn't seem to exhibit much fear. But how does that affect option strategies?

Strategy talk: Implied Volatility at Multi-Year Lows

Option players who do not build implied volatility into their strategies ignore one of the most important variables in the option pricing mix. The problem is that implied volatility is not as visible as movement in the underlying stock or ETF. That's why they created the VIX index. It measures the overall market's implied volatility, and if you use the SPY or QQQ as a market benchmark for price, you should also use VIX as a benchmark for IV.

While many individual stocks may still exhibit high levels of implied volatility, the low level of VIX suggests that implied volatility is somewhat lower across the board. That means that options are generally less expensive. Good news for buyers, bad news for writers.

Thus, if you're writing, you'll likely be getting somewhat lower returns right now. That could tempt you to write at strikes that are more in-the-money than usual, which increases your risk. In addition, implied volatility does not tend to move up gradually. It tends, instead, to spike upward. That also increases your risk as a writer.

On the other side, buying could actually be more attractive here, as there is an increased chance of making money not just from direction but from a volatility spike as well.

Big option players such as hedge funds and institutions are well tuned in to implied volatility, and their action on VIX options lately shows a lot of interest. June monthly options on VIX have considerable volume and open interest. The VIX June 16, 18, and 20 calls all have over 200,000 contracts open as of today (Tuesday 5/21). The volume on the June 14 call was over 75,000 today and the June 15 call volume was over 50,000. Even many of the June put strikes have over 100,000 open interest.

Institutions are more likely hedging their portfolios than speculating but the action is noteworthy. Historically, VIX has almost nowhere to go but up from here. We just don't know when.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.