Post-Earnings Reactions

March 1, 2024

The Markets at a Glance

SPY

NVDA's continuing earnings explosion did its part to affirm the power of the AI revolution and keep the bull charging ahead. As a result, both SPY and QQQ continued their trends upward from last October and VIX once again rolled over from a recent peak near 16 to back below 14.

(By the way, the parallel trend channel on the SPY chart was just one of the new features that have been added to the chart functions in IVolLive. If you haven't tried them yet and you're a creative chart lover, you should check out the new features!)

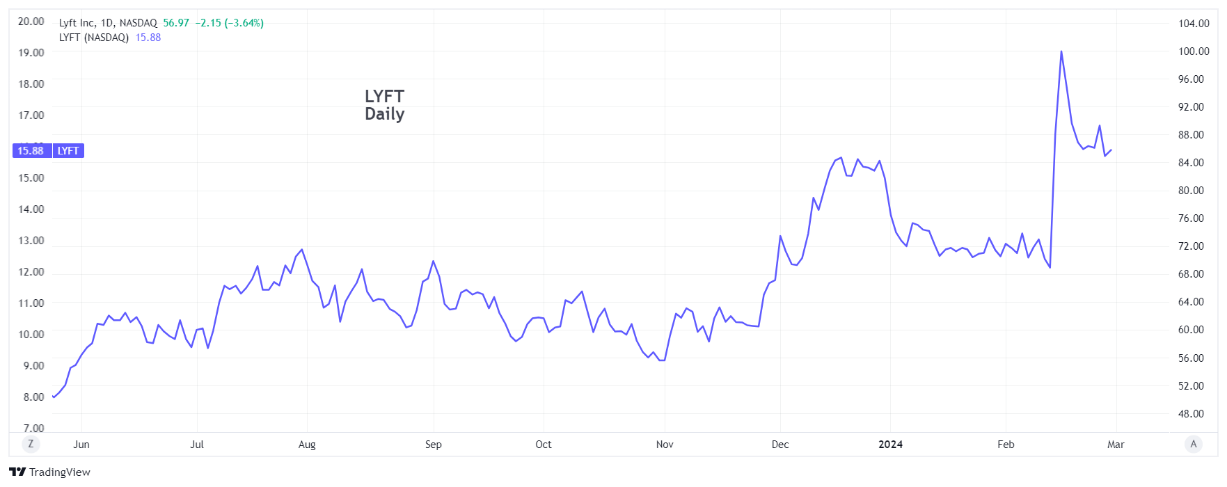

But while the advancing trend in SPY looks tame, lots of crosscurrents are happening underneath, particularly in response to earnings announcements. Companies like Expedia (EXPE) had disappointing earnings, while companies like Lyft (LYFT) and First Solar (FSLR) had very positive earnings (more on these below.) In addition, as a rally is prone to do when it reaches its late stage, it exhibits rotation, as investors begin to take profits out of some sectors and roll them into others.

One sector to watch is biotechs. The sector has come alive, claiming the top four spots for the week in advancing stocks, each with over 200% gain for the week! The sector had a very strong rally in November and December of 2023, followed by a consolidation over the last 6-7 weeks. But now it may be gearing up to enter another new leg up. ETFs like XBI, IBB, and IBBQ may be worth watching.

Strategy talk: Post-Earnings Reactions

Post-earnings announcement option strategies are very different from pre-earnings announcements. Before an earnings announcement, option strategies are primarily driven by implied volatility. As an announcement approaches, option players pay up to either speculate on a move up or protect against a move down. Regardless of the directional leaning of the crowd, a move of some sort is generally anticipated, causing option demand to increase, prices to rise, and IV to increase on all of a stock's near-term options, often substantially. The pros know that the play is generally to capture some of that excess premium coming from implied volatility.

Even if a trader has good insights on whether earnings on a particular stock will be good or bad, playing direction with long calls or puts is ill-advised since the high IV will take a toll on all long option positions. Thus, even if you are correct on direction, you can still lose money when the time premium on your option collapses immediately after the announcement. Besides, you can also frequently guess correctly on the news, but incorrectly on the market's reaction, which can often see a stock sell off even after a good earnings report.

After earnings are announced, stocks will frequently make their initial move and implied volatility will shrink immediately back toward a more normal level. (Usually, the implied volatility of options in distant expirations on the same stock will tell you where the 'normal' level is for that stock.)

The key to developing post-announcement option strategies is not the implied volatility. It now becomes the direction and the momentum of the stock. The initial reaction, which might last a few hours to a few days is often at least partially retraced. The stock then tends to continue in the direction of its general overriding trend (momentum). Three examples are shown below: LYFT, which had a big jump and retraced almost half of it; EXPE, which had a big drop and then retraced part of it; and FSLR, which had a big jump right away, correcting most of it within hours, and moving up again now.

The point here is not that there is any kind of rule about how a stock will react to earnings. It is that the option strategy before the event should be different than after the event. Prior to earnings, writing options should take a priority - covered calls, naked puts, short straddles, and short strangles. After the announcement, the initial strategy can often be closed. A new strategy can then focus more on a long position - long stock, long call or put, diagonal spreads, etc. since implied vol has been greatly reduced. (That doesn't mean you shouldn't hedge those positions if you want to, but that the long side becomes the primary part of the strategy).

As to direction, stocks do tend to correct the initial reactions and then continue in the direction of that initial reaction as more people become aware of the earnings news and continue to act on it. You cannot count on that to happen every time, but what you can definitely count on is the collapse of implied volatility immediately following the news in most cases.

Got a question or a comment?

We're here to serve iVol users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.